POLICY INSIGHT

Education Savings Accounts

Introduction

DIFFERENT TYPES OF SCHOOL CHOICE PROGRAMS

School Vouchers: This type of program allows parents to use public funding allocated for their child toward tuition at a private school of their choice, including religiously affiliated private schools. Most voucher programs typically start out targeted toward certain groups of students such as those with disabilities, those zoned to a failing school, or those from low-income families. Some states, such as Indiana, have expanded their programs to include more middle-income families. School vouchers give parents the freedom to choose a private school for their children, using all or part of the public funding set aside for their children’s education.

Under such a program, funds typically spent by a school district would be allocated to a participating family in the form of a voucher to pay partial or full tuition for their child’s private school, including both religious and non-religious options. There are 25 voucher programs in 16 states—Arkansas, Georgia, Indiana, Louisiana (2), Maine, Maryland, Mississippi (2), New Hampshire, North Carolina, Ohio (5), Oklahoma, Utah, Vermont, Wisconsin (4)—and Washington, D.C., and Puerto Rico.

Tax-Credit ESAs: Tax-credit ESAs allow taxpayers to receive full or partial tax credits when they donate to nonprofit organizations that fund and manage parent-directed K-12 education savings accounts. Families may use those funds to pay for multiple education-related expenses, including private school tuition and fees, online learning programs, private tutoring, community college costs, higher education expenses and other approved customized learning services and materials, and roll over unused funds from year to year to save for future educational expenses. Some tax-credit ESAs, but not all, even allow students to use their funds to pay for a combination of public school courses and private services. Only three states currently allow tax-credit ESA programs: Kentucky, Florida, and Missouri.

Tax-credit scholarships: Through this type of program, the state uses tax-credits to incentivize businesses or individuals to donate money to a scholarship granting organization, which then gives money to students to use toward tuition at a private school. To qualify, students usually have to be from a low-income family, a failing school, or have other special needs. Some states offer another variation, such as individual tax-credits or deductions.

529 Plans: 529 Plans, created as part of the Small Business Job Protection Act in 1996, were originally meant to give parents a tax-advantaged way to save for college expenses. Parents could get federal income tax benefits as long as they used the money for certain qualified educational expenses—all at the postsecondary level.

Anyone can open a 529 plan with anyone else as a beneficiary. Adults can even use them to save for continuing educational expenses. But the most common use is for parents or other relatives to open a 529 account with a child as the beneficiary. This means the money is to be used for the child’s education, but the parent or other account custodian actually controls the funds.

As long as the money is used for the beneficiary’s allowable educational expenses—including up to $10,000 per year in private K–12 tuition expenses or college-related tuition, fees and other expenses—it grows federal income tax-free.

Education savings accounts: In an ESA program, the state sets aside money usually based on its per-pupil funding formulas in individual accounts for participating students. Their parents or guardians can then withdraw that money to spend on approved educational expenses. That may be private school tuition, but it may also be used for tutoring, online courses, transportation, or even some types of therapy. In addition to helping families send their children to private school, an ESA program can also allow them to home school or put together a hybrid public-private education. ESAs were initially aimed at students with disabilities, but Arizona has been steadily expanding eligibility to its program to include other groups of students, such as those from failing schools, military families, and students who live on American Indian reservations.

Education Savings Accounts enable parents to “withdraw their children from public district or charter schools and receive a deposit of public funds into government-authorized savings accounts with restricted, but multiple, uses.” The accounts operate much like a debit card that parents can use to purchase approved educational services for their children, such as private school tuition, private tutoring fees, community college costs and other customized learning services.

EdChoice explains here (1 min).

COVERDELL EDUCATION SAVINGS ACCOUNTS

The Education Savings Accounts discussed in this Deep Dive are different from the Education Savings Accounts such as the Coverdell, which are set up by a bank to work like a 529 and are funded through personal funds, not state tax dollars.

Coverdell education savings accounts, or Coverdell ESAs, used to be known as Education IRAs. As you might guess from that name, this type of account offers a tax-advantaged way for parents to save money for a specific purpose—namely, their children’s education.

Coverdell ESAs are a federal program similar to 529 college savings plans. They offer tax-free growth for your investment and tax-free withdrawals. Unlike 529 plans, parents can use their Coverdell ESA funds to pay for certain K–12 educational expenses as well as college expenses.

The key distinguishing factor with Coverdell ESAs: To get a Coverdell ESA, families must choose to open an account and contribute money out of their own pockets to accrue savings. In other words, any parent can open a Coverdell ESA, but they have to have the money.

EDUCATION SAVINGS ACCOUNT PROGRAMS IN K-12

K–12 education savings accounts, usually referred to as ESAs, are taxpayer-funded spending accounts the government offers eligible families, so they can use the funds—often in the form of a debit card—to pay only for educational expenses that tailor an education to their children’s specific needs. The “savings” in the name of this program type comes from parents’ ability to save funds from quarter to quarter, or school year to school year, to use for future educational expenses, such as college tuition or more expensive learning therapies etc.

The key distinguishing factor with ESA programs in K–12 education: The money doesn’t come from parents’ pockets; it comes from the tax dollars the government already sets aside for every child’s education. Instead of that money going directly to a government-assigned school your child might not attend, the money follows your child to the school or other education provider you choose for them.

Though ESAs and Coverdell ESAs confusingly share an acronym, they have very different backgrounds and purposes.

WHY IT MATTERS

According to a recent statistic from the National Center for Education Statistics, the number of students ages 3-21 who received special education services under the Individuals with Disabilities Education Act has averaged roughly 14- 15% of all public school students since 2000. In 2022, there were 7.3 million public school students receiving services. Of those, one-third have specific learning disabilities. Having choices in educational services allows all children to receive a customized education experience that can meet their individual learning needs, thereby preparing them for the future.

Putting it in Context

HISTORY

For years, the state of Arizona pursued alternative options to traditional local public schooling. In addition to many smaller local initiatives such as open enrollment policies and charter/magnet schools, the state adopted two small pilot voucher programs in 2006. Arizona courts later ruled these programs to be unconstitutional; because the vouchers allowed parents to send their children to private schools, including religious schools, using state money, it was seen as a transfer of state funds to religious institutions.

The state legislature then passed Lexie’s Law, a corporately-funded tax credit scholarship program to help fund private school scholarships for children with disabilities. Under this legislation, corporations and insurance companies may claim a tax-credit for donations to private charities that award scholarships to children who are eligible for these voucher programs. However, this program proved difficult to fund, which left parents and legislators looking for another way to offer parents more educational options. In 2011, Arizona lawmakers passed the nation’s first law establishing ESAs, called the Arizona Empowerment Scholarship Account program. The program was challenged in court, and in 2014 the Arizona Supreme Court ruled that ESAs were not in violation of the constitution.

There are currently ESA programs in 13 states (as of January 2024): Arizona, Arkansas, Florida, Indiana, Iowa, Mississippi, Montana, New Hampshire, North Carolina, South Carolina, Tennessee, Utah, and West Virginia. As of 2022, 30,992 K-12 students in the U.S. were recipients of ESAs. Below is a general timeline of some of the development of critical ESA programs:

Arizona: 2011 “Empowerment Scholarship Account”

- The first state to enact an education savings account program

- For students with special needs and circumstances, such as foster children, children with parents on active military duty, and children living on Native American reservations.

- An attempt to expand the program to make all K-12 students eligible to apply for an ESA was defeated in a 2018 referendum

Florida: 2014 “Gardiner Scholarship Program”

- Created for students with special needs

- Parents can use the funds to pay for a variety of educational services, including private school tuition, tutoring, online education, home education, curriculum, therapy, postsecondary educational institutions in Florida and other defined educational services

Mississippi: 2015 “Equal Opportunity for Students with Special Needs Program”

- Allows Mississippi students with special needs to receive a portion of their public funding in a government-authorized savings account with multiple uses

Tennessee: 2015 “Individualized Education Account”

- Gives parents of students with special needs access to an Individualized Education Account (IEA)

- An IEA can be used for a variety of educational expenses, including private school tuition, private tutoring, learning therapies and more

- In May 2020, a county judge ruled the program was unconstitutional and that Tennessee had “improperly imposed the program” on Davidson and Shelby counties, home to Nashville and Memphis

Nevada: 2016 “Education Savings Account Program”

- The nation’s first universal ESA program

- Allows parents to remove their children from their assigned public schools and access a portion or all of their children’s public education funding to pay for services like private school tuition, curriculum, learning therapies, tutoring, and more

- In 2016 following two lawsuits, the Nevada Supreme Court upheld the ESA program but not its funding mechanism, meaning the state legislature must create a new funding legislation. In 2017, a standoff in the state legislature resulted in a funding bill dying and funding previously earmarked for the ESA being transferred back into the public education fund, with a portion allocated to a tax credit scholarship

North Carolina: 2017 “Personal Education Savings Account”

- Enacted in 2017 to begin providing funding to students in the 2018–19 school year

- Serves some students with special needs and can be used in conjunction with the state’s two voucher programs

- Provides families funds to pay for a variety of educational services

Five States Enact New ESA Programs in 2023:

- Arkansas: Signed the Arkansas LEARNS Act in March which created Education Freedom Accounts, providing $6,600 to eligible students to eligible expenses.

- Utah: Signed HB 215, Funding for Teacher Salaries and Optional Education Opportunities, in January. Among other things, this created the Utah Fits All Scholarship, which will allow students to receive $8,000 for approved educational expenses per year.

- Iowa: Signed into law in January 2023, The Students First Act, provides roughly $7,500 for approved educational expenses.

- Montana: Signed House Bill 393 in May 2023 creating the Special Needs Equal Opportunity Education Savings Account Program.

- South Carolina: Signed the Education Scholarship Trust Fund Act into law in May. This program provides up to $6,000 for low-income households approved educational expenses.

How Education Savings Accounts Work

Each state has its own set of guidelines to determine which students are eligible for ESAs and how much funding students receive. Similarly, each jurisdiction has its own way of administering the program, including determining which services are eligible to be purchased with ESA funds and whether the state or a third-party company will administer the program. However, the programs generally operate in a similar manner.

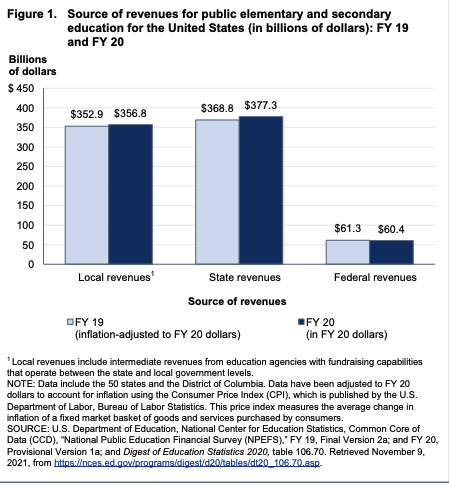

Public schools are funded through a combination of local, state, and federal resources. The U.S. Department of Education states it contributes roughly 8% of the elementary and secondary education budget, with state and local governments funding the remaining 92%. Specific state allocations can be found here.

FUNDING

ESAs are funded based upon the state’s average “per pupil funding.” This figure is derived from taking the operational budget of a school system and dividing it by the total number of students the system serves, but not all states do it exactly the same. For example, Arizona and Nevada give 90% of the total per pupil revenue (federal, state, and local) that would otherwise go to the public school to the ESA program. The final 10% of funds for that student are used to cover administrative costs associated with the program’s oversight. In Tennessee, ESA funding is based only on state and local funding, not federal.

The ESA funds are placed into an account for use by parents to pay for educational expenses such as tuition for a private school, supplies such as textbooks or technology expenses, private tutoring, or specialized educational or therapeutic services based on the needs of the student. These expenses are audited by the servicing entity (a contracted third party, as is the case in Florida, or the state, as is the case in Arizona) to ensure that the funds are being used properly. Most states allow unused funds to be rolled over for later educational expenses such as college tuition. To ensure that there is no double funding, students enrolled in an ESA program are not allowed to concurrently attend public school.

This infographic, based on Pennsylvania legislation, illustrates how ESAs work.

The fact that ESA funds come from taxpayer money is a main concern for many opposed to ESAs. Since one use for ESA funds is for private schools, and this includes religious schools, it would mean taxpayer funds are being used for religious schools, which runs “counter to state and federal principles of separation of church and state.” The July 2020 Supreme Court ruling in Espinoza v Montana Department of Revenue, however, found that “the state of Montana cannot exclude religious schools from receiving tax credit-funded scholarships under its school choice program. This ruling could mean that other states would not be allowed to exclude religious schools in their school choice programs.

Those who oppose ESAs also often cite the concern that funding for ESAs is diverting already scarce resources away from public schools and the students who remain enrolled there. For example, the federal government’s Impact Aid Program (part of the Elementary and Secondary Education Act of 1965) provides financial assistance “to local school districts with concentrations of children residing on Indian lands, military bases, low-rent housing properties, or other Federal properties,” which means they operate with less local revenue than other school districts because Federal property is exempt from local property taxes. The National Coalition for Public Education argues this aid allows schools to coordinate “comprehensive systems of support for students, and professional development for school personnel,” and ESAs could drain these funds.

Whether this is true is still to be determined since few states have had their ESA programs implemented for long periods of time, and there is a “lack of requirements in the laws for program evaluations or for states to collect the data needed for a serious study.” In Arizona, however, families for non-special needs students received an average funding of just over $6,000 in 2019, approximately $4,000 less than Arizona’s public school average per pupil spending. In fact, for fiscal year 2020, Arizona’s budget includes “an explicit subsidy for the public school system using ESA program savings,” with approximately $3 million going to updating the Department of Education’s IT system.

At the same time, this relatively small amount of funding has some questioning whether it is enough for all families to provide their children with educational options; for the 2020-2021 school year, the average private school tuition in Arizona is just under $10,500, with the elementary school average about $6500 and the high school average just over $16,000. “For a lower-income family with few additional resources to supplement this amount, choices will be limited – particularly once transportation issues are taken into account,” argues one National Education Policy Center report.

RECIPIENTS

Each state determines the specific eligibility requirements for their respective ESA program. The primary benefactors of ESAs have been students with special needs, as well as students with challenging circumstances, such as children in military families (who tend to move frequently) and those who are in foster care. There are some states that have proposed a model of universal eligibility, where any student would have access to ESA funds, but they have faced legal challenges in doing so. Two examples are Nevada and Arizona. In 2016 Nevada passed a bill that provided this universal expansion of eligibility, but it was rescinded in 2017 due to a political standoff that has since left the state’s program in limbo. Arizona’s attempt to expand the program to make all K-12 students eligible to apply for an ESA was defeated in a 2018 referendum.

Since local public schools are part of the fabric of a community, this often leads to a community desire to protect local public schools and the concern that if more students have access to ESAs, more students will leave the public school system which could result in a drain of resources from public schools. As mentioned previously, studies attesting to this are limited.

Additionally, some school funding is determined by the Census data of how many children live within a certain district, so overall funding to public schools should not be seriously affected by a small portion of students choosing not to attend public schools; it may even mean that there are more funds per pupil available in the public school.

Two factors are metrics to determine ESAs’ success: parental satisfaction and academic progress. In a 2016 parent survey conducted by the National Center for Education Statistics, data showed that parents were more satisfied with educational options of choice, as opposed to traditional public schools of assignment. Only 54% of parents whose child attended a public school of assignment were satisfied with the school, as opposed to 77% who had children attending a private school.

Even if universal eligibility was a factor, many states also set enrollment caps to limit the number of students who can enroll in ESA programs. This means that while the pool of eligible students is larger, the number of students accepted would not increase, so there would not be a drastic drain on public schools. At the same time, enrollment caps with an expanded applicant pool also raises concerns about which students are accepted. ESAs were originally created to give expanded options to students with special learning needs. If all students are allowed to apply for ESAs, there may be tension between deciding whether to prioritize students with special learning needs or ensuring all students have equal access and opportunity to apply.

ACCOUNTABILITY

Audits ensure ESA funds are not being misused, and each state does these differently. In Florida and Mississippi, “parents or guardians must justify costs when asking for fund reimbursement.” Arizona and Tennessee “distribute funds directly to a bank account on a quarterly basis and monitor transactions with random audits” (Education Commission of the States). How timely and effective these audits are in managing the programs and preventing fraud is unclear. The Arizona Office of the Auditor General’s review of the state’s ESA program found over $100,000 in misused funds between August 2015 and January 2016, including parents who did not submit required expense reports and parents who purchased items that were not eligible for ESA funds. A 2019 audit of Florida’s ESA program by the Florida Auditor General found that Step Up Inc., the third party in charge of administering the ESA program, did not always properly evaluate applicants and spent $280,000 in program funds on expenses not related to the program.

Fraud and misuse of funds are not unique to ESA programs; audits of public schools from around the country have revealed misuse of public funds due to “poor record keeping” and “accounting practices that misclassified expenditures.” And within ESA programs, calls for “much more stringent monitoring…to safeguard the proper use of public funds” have been effective. After a series of recommendations undertaken by the program staff at Arizona’s Department of Education, a follow-up audit found that in over 168,000 transactions between October 2018 and October 2019, there was “only one successful transaction at an unapproved merchant totaling $30.” Additionally, the audit found the program was understaffed; while this could have contributed to even more accounts of misused funds never being reported, it also contributed to poor customer service that left many families confused as to what services and expenditures were eligible.

MEASURING SUCCESS

A major factor in determining the success of ESAs is academic progress. Traditional public schools use tools such as standardized tests to determine academic success, and, “given that school choice programs rely on public funds, there is a fair argument that taxpayers deserve assurance that students are progressing academically” with an ESA program. Curriculum requirements and teacher qualifications are not factors considered in determining what educational expenses ESA funds can be used for. In some states, parents must submit data on their children’s academic progress, but assessments are not standardized, and therefore difficult to measure.

It should be noted that students with special needs typically use alternative assessments, so the requirement of typical standardized tests would be inappropriate for a majority of students using ESAs. If legislation is included to utilize academic progress as a metric of success, careful steps should be taken to ensure that the assessment used to determine this progress fairly reflects the students’ abilities. For example, in the case of special needs students, the same alternative assessments that are used in the traditional public schools should also be used when assessing students utilizing the ESAs. That said, not everyone agrees that academic progress should be used to determine if ESAs are successful.

Another important factor to consider is satisfaction. If parents are pleased with their decisions regarding their child’s education, and the child is learning and living well thanks to the chosen educational environment, then on that personal level the ESA was put to good use. If children are not making academic progress, then parents can choose a different option for their children.

Ivan Carrasco was a shy child who was a victim of bullying at his elementary school. He also struggled in reading and got poor grades, which added to his frustrations. His mother Jeanet’s efforts to meet with school leadership to address her concerns about her son were unsuccessful, but she found new hope for her son when she heard about Arizona’s Empowerment Scholarship Accounts (Arizona’s version of ESAs).

With the account, she was able to enroll him in a private school that met his individual needs. He entered fourth grade reading at a second-grade level, but had caught up with his peers after two years. By the time he was in the seventh grade, he was reading at an eighth grade level. The ESA provided Ivan the flexible education offerings he needed to meet his learning needs.

See examples of two more students who benefited from ESAs, The Heritage Foundation: How Education Savings Accounts are Empowering Families (8 min).

Legislation

ESAs are only one of the many school choice options available for families looking outside of public schooling options, including vouchers (12 states and the District of Columbia), tax-credit scholarships (18 states), charter schools (44 states and the District of Columbia), and private school choice programs (26 states and the District of Columbia). Take a look at EdChoice’s Interactive Map to see what options exist in your state.

The Education Freedom Scholarships and Opportunity Act would create a $5 billion annual federal tax credit for businesses and individuals who voluntarily donate to scholarship granting organizations (SGOs). In exchange for these donations (for which there would be a cap), contributors receive “a nonrefundable, dollar-for-dollar tax credit; meaning their income taxes would be reduced by the amount they donate.” This structure means “[n]o family is forced to accept a scholarship, no taxpayer is forced to contribute, no organization is forced to participate, and no state is forced to participate.”

Each individual state that chooses to participate – rather than the federal government – would be in charge of identifying eligible SGOs and determining which education expenses are approved and which students are eligible. Funds would pay for K-12 education options such as private school tuition, private tutoring, Advanced Placement courses, online classes and educational technology, career and technical education or internships and apprenticeships, day care or after-school programs, instructional materials for home education, and special education services for students with unique learning needs. As with ESAs, the main concerns with EFS are that it will drain resources from public schools and, because only public schools need to adhere to the federal Individuals with Disabilities Education Act, students with special learning needs could be overlooked.

In the short term, EFS has been considered as a means of providing emergency assistance to students and their families as Americans across the country deal with the COVID-19 pandemic. If approved, the short term EFS legislation would authorize “one-time, emergency appropriations for scholarship-granting organizations in each state.” These SGOs would provide families with direct education assistance to find the best education options for their children, as well as “help private schools survive coronavirus, and present an influx of students into public schools that may already be struggling with oversize classrooms.”

Some argue this is necessary because many parents have lost jobs, which makes it more difficult to afford education alternatives to public schools. Virtual learning options over recent years proved inadequate, and not all families have equal technological access. Others argue this would undermine public schools because public schools have been facing budget cuts and a lack of guidance, and that they would be able to provide better services and safe in-person learning with more resources.

Conclusion

Preparing children to be productive members of society begins with education. A challenge set before families, communities, job creators and educators is how to ensure all children, regardless of backgrounds, life situations, and abilities, have the best possible education. This will allow them to succeed as active contributors to the economy and society at large.

What You Can Do to Get Involved

Measure: Find out what your state and district are doing about education options.

- Do you know what educational options exist in your state?

- If options exist, how many students participate in them?

- What school district are you in?

- What is your school district’s budget? Do you know what the average spending per pupil is?

- Is there an education coalition or task force, or does one need to be formed?

Identify: Who are the influencers in your state, county, or community? Learn about their priorities and consider how to contact them, including elected officials, boards of education, city councils, journalists, media outlets, community organizations, and local businesses.

- Who are the members of boards of education in your state? Who is on your district’s school board?

- What steps have your state’s/community’s elected/appointed official taken?

- Who are the local organizations or groups that are involved in education reform near you?

Reach Out: You are a catalyst. Finding a common cause is a great opportunity to develop relationships with people who may be outside of your immediate network. All it takes is a small team of two or three people to set a path for real improvement.

- Find allies in your community or in nearby towns and elsewhere in the state.

- Foster collaborative relationships with community organizations and school boards.

Plan: Set some milestones based on your state’s legislative calendar.

- Don’t hesitate to contact The Policy Circle team, [email protected], for connections to the broader network, advice, insights on how to build rapport with policy makers and establish yourself as a civic leader.

Execute: Give it your best shot. You can:

- Apply for The Policy Circle’s CLER Program to join a community of like-minded women learning better skills to be effective business and civic leaders in their communities.

- Set up a meeting with your state representatives to discuss their views and understandings of ESAs, or attend school board meetings to ask questions, find out about priorities, and review annual budgets.

- Meet with a family who chooses private or charter schools as an option for educating their children, and ask their views.

- Volunteer at your child’s school to learn about teachers’ views, how the school runs, and how decisions are made.

Newest Policy Circle Briefs

Assessing Candidates Guide

The First-Time Voter Handbook

Women and Economic Freedom

About the policy Circle

The Policy Circle is a nonpartisan, national 501(c)(3) that informs, equips, and connects women to be more impactful citizens.