Introduction

View the Executive Summary for this brief.

Policy Circle’s president and co-founder, Sylvie Légère Ricketts, and editor, Kristin Jackson, are joined by special guests Andrew Biggs from the American Enterprise Institute and Brian Riedl of the Manhattan Institute to launch this brief. Listen to the 30 minute call below.

Why it Matters

The goal of safety net programs is to help Americans get back on their feet after hardships, and to provide those in need with a basic standard of living. This goal is widely supported, but the means of achieving this goal are heavily debated. Experts and analysts agree that these programs are rapidly driving up U.S. debt and will start running out of funding in the coming decade. At the same time, some argue these programs are not meeting the needs of Americans. Reform is necessary, but politically difficult since the resolutions involve either cutting benefits or raising taxes, two very unpopular ideas that do not win elections.

Putting it in Context

History

Providing for Americans in need has its roots in our nation’s founding. Often referred to as “social insurance” programs, such efforts have existed since colonial times. In the colonies, “poor relief” was organized and carried out on the local level and was based on charitable contributions. One of the earliest laws for poor relief was a 1768 Maryland law requiring the building of ‘alms houses’ and ‘work houses’ to address the growing poor. Alms houses were for orphans, the disabled, and elderly. Vagrants, beggars and the idle were sent to ‘work houses’ for no more than three months to learn a skill so they could eventually become independent.

In 1797, Thomas Paine, an advocate for the independence of America, advocated for social insurance to be created for the newly independent country. But America did not go down this path until the Civil War, when pension plans were created to entice recruits, first providing benefits to wounded soldiers, then to all soldiers, and then to survivors as well.

During the first two decades of the 20th century, the government debated state and national old age pension and workers’ compensation systems, with the courts overturning many federal-level initiatives. The debate reflected the change from a pre-industrial society, where people could subsist from their land, to an industrial nation illustrated by a population shift from rural areas to urban centers. In 1923, Montana passed an old age pension law and by 1929 all but four states had workers’ compensation laws in effect.

Everything changed for American citizens when the stock market crashed on October 24, 1929 and the country fell into a decade-long depression. President Franklin Roosevelt “believed that the sheer scope of the Depression demanded the federal government’s intervention. With the support of a largely Democratic Congress, Roosevelt’s Hundred Days ushered in the first wave of New Deal legislation designed to hasten ‘Relief, Recovery, and Reform.’”

Waiting for relief check during the Great Depression. Source: Wikimedia Commons

This meant a shift away from the traditional American political philosophy of laissez-faire (limited government intervention), and towards “the concept of a government-regulated economy aimed at achieving a balance between conflicting economic interests.” This resulted in the Social Security Act of 1935. Benefits would be given to retirees through a 2% payroll tax on current workers’ wages, split between employer and employee. The American people started paying the 2% payroll tax in 1937.

WOMEN IN HISTORY: The Roosevelt Institute refers to Frances Perkins as ‘The Force Behind Social Security.’ She served as chair of the Committee on Economic Security and was the Secretary of Labor for FDR. Perkins was the first female head of a federal agency. (Source: Francis Perkins Center)

According to the LBJ Library, FDR had originally wanted a national level health insurance program, but he dropped it from the Social Security Act to ensure passage. Presidents Harry Truman and John F. Kennedy also made efforts that did not pass. President Lyndon B. Johnson made this program a headline of his agenda, known as the War on Poverty. Key pieces of War on Poverty legislation that are now central components of federal entitlement programs include:

- The Social Security Amendments of 1965, which created Medicare and Medicaid, and expanded Social Security benefits (through an increase in payroll tax) for retirees, widows, the disabled, and college-aged students;

- The Food Stamp Act of 1964, which made the food stamps program permanent.

- The Elementary and Secondary Education Act of 1965, which established the Title I program that subsidizes school districts with a high percentage of students from low-income families.

The Basics

To understand the federal safety net, it is helpful to first look at the federal budget, which has two types of spending: discretionary spending and automatic, or mandatory, spending. The Policy Circle’s Federal Debt Brief breaks these down further, but this is the basic idea:

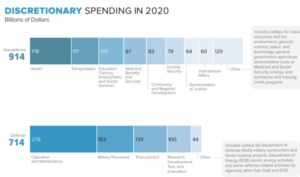

Discretionary spending is spending that lawmakers control annually through appropriation acts. Discretionary spending funds programs such as education, veterans affairs, infrastructure and defense. Discretionary spending averaged 7.2% of GDP between 2000 and 2019. In 2020, the U.S. government spent $1.6 trillion in discretionary spending (7.8% of GDP), broken down in the chart below:

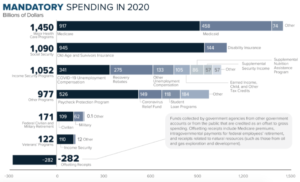

The rest of the federal budget is automatic spending or mandatory spending, meaning spending for benefit programs for which laws set eligibility rules and benefit formulas; the government is legally required to pay these benefits, so they are automatically deducted from the federal budget through scheduled payments. Between 2000 and 2019, average mandatory spending outlays came to 11.7% of GDP; in 2020, due to increased spending in response to the coronavirus pandemic, mandatory spending was 21.8% of GDP, amounting to $4.6trillion. The chart below breaks it down:

From Medicare and Medicaid to disability insurance and income security, many of the programs appearing in these two charts are part of the federal safety net. They are commonly known as entitlement programs, which are enacted by federal law. Specifically, this includes:

- Medicaid – a joint federal-state program designed to provide health coverage to low-income adults and children, pregnant women, and disabled individuals. Connected to Medicaid is the Children’s Health Insurance Program (CHIP), which provides federal matching funds to states to provide health coverage to children in certain low-income families. In June 2021, over 76 million individuals were enrolled in Medicaid and 6.9 million were enrolled in CHIP.

- Medicare – a health insurance program for people age 65 and older. This includes hospital insurance, medical insurance, and drug coverage. As of 2020, there were over 61 million medicare beneficiaries.

- Social Security – a retirement program that also provides life insurance and disability insurance. Almost all workers participate in Social Security by making payroll tax contributions. In 2020, 69.8 million individuals received benefits from Social Security programs. As of December 2020, nearly nine out of ten individuals age 65 and older were receiving a Social Security benefit. Retired workers accounted for 75.2% of total benefits; disabled workers accounted for 13.1% of benefits; and survivors of deceased workers accounted for 11.7% of total benefits. In June 2021, the Social Security Agency reported the average monthly benefit per beneficiary ranged from $1,280 to $1,555.

- Unemployment Insurance – programs operated by states or jurisdictions that provide unemployment benefits to eligible workers who become unemployed through no fault of their own (meaning they were not fired, for example). Unemployment insurance has been highlighted due to layoffs prompted by the coronavirus pandemic.

- Welfare – programs that provide benefits to low-income individuals and families, and are not mandated by law so are not considered entitlements. To qualify for welfare, individuals need to make less than the federal poverty threshold (some states and programs, like SNAP, go up to 130% of the poverty line) and need to regularly show proof of their income. Programs include:

- Refundable Tax Credits – the Earned Income Tax Credit (EITC) and the Child Tax Credit, two tax credit programs that distribute money to low-income Americans.

- Supplemental Nutrition Assistance Program (SNAP) – formerly known as the food stamp program. Participants receive a debit card that is accepted in most grocery stores.

- Housing Assistance – programs including rental assistance, public housing, and some community development grants.

- Supplemental Security Income (SSI) – pays cash to low-income individuals over 65 years of age, or younger if the individual is disabled.

- Pell Grants – grants specifically for students from low-income households to access postsecondary education.

- Temporary Assistance for Needy Families (TANF) – a federally funded, state-run program that pays cash to to help low-income families with children achieve economic self-sufficiency.

- Child Nutrition – programs that provide free or reduced price meals for children from low-income households, such as school lunch, breakfast, and after school programs.

- Head Start – a preschool program available to children from low-income families.

- Job Training Programs – training programs administered by the to provide job training, displacement and employment services.

- Women, Infants, and Children (WIC) – provides healthy food to pregnant women and children up to five years old.

- Child Care – a block grant program to states and local public and private agencies that administer child care programs for low-income families.

- Low Income Home Energy Assistance Program (LIHEAP) – aids low-income households that pay a high proportion of household income for home energy.

- Lifeline – provides discounted phone services and cell phones to low-income individuals.

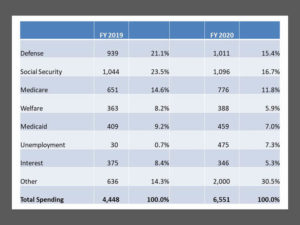

The following chart breaks down spending for each of these major programs, and compares total spending on assistance programs to defense spending, another major component of the U.S. budget.

The Role of Government

The role of the federal government in government assistance programs is up for debate. Some point to the first clause of Article 1 Section 8 of the U.S. Constitution which outlines the powers of the legislative branch including the provision to provide for the “general Welfare of the United States;” Others posit that the original goal of that clause, as interpreted through the Federalist Papers, is that the legislative branch (i.e. Congress) should only fund those powers that were duly enumerated, so government assistance programs should be handled at the state and local level, not at the federal level.

Federal

Congress

The following Congressional Committees have jurisdiction over welfare and government assistance programs:

- Senate Committee on Finance (jurisdiction over health programs under the Social Security Act including Medicare, Medicaid, CHIP, TANF, and other HHS programs financed by specific tax or trust fund)

- Senate Committee on Health, Education, Labor & Pensions (jurisdiction over “measures relating to education, labor, health, and public welfare,” including aging, individuals with disabilities, and public health)

- Subcommittee on Children and Families (jurisdiction over Head Start, Child Care block grants, and women and children’s healthcare)

- Subcommittee on Primary Health and Retirement Security (jurisdiction over private retirement plans and the Pension Benefit Guaranty Corporation)

- Senate Appropriations Committee (writes legislation that allocates federal funds – meaning discretionary spending)

- Subcommittee on Labor, Health and Human Services, Education, and Related Agencies (jurisdiction over funding for Department of Labor, Health and Human Services, Department of Education, Social Security Administration)

- House Committee on Energy and Commerce (jurisdiction over health care and health insurance including Medicare and Medicaid)

- Subcommittee on Health (jurisdiction over Medicare, Medicaid, CHIP, and HHS)

- House Committee on Ways and Means (jurisdiction over “all taxation, tariffs, and other revenue-raising measures,” as well as programs including Social Security, unemployment insurance, Medicare, and TANF)

- Subcommittees on Health; Social Security; Worker & Family Support

- House Committee on Appropriations (responsible for appropriating funding for most federal government functions)

- Almost all subcommittees touch on one or more government assistance programs

Federal Agencies

A number of federal agencies administer government assistance programs, including:

- Internal Revenue Service – Earned Income Tax Credit and Child Tax Credit

- Department of Agriculture – SNAP, Child Nutrition, and WIC

- Department of Labor – Job Training and Unemployment Insurance

- Health and Human Services – TANF, Head Start, LIHEAP, Child Care

- Housing and Urban Development – Housing and rental assistance

- Department of Education – Pell Grants

- Federal Communications Commission – Lifeline

- Social Security Administration – Social Security and Supplemental Security Income

- Centers for Medicare & Medicaid Services – Medicare, Medicaid, and CHIP

State & Local

States and municipalities play an important role in most federally-run government assistance programs as intermediaries between beneficiaries and the federal agencies that run the programs. In many cases, to apply for benefits, individuals must contact their state or local offices, such as for SNAP and TANF. In some cases, eligibility criteria for different programs varies by state, as is true for Medicaid and CHIP.

States and municipalities are also directly in charge of block grants. Block grants from federal agencies distribute funds to states, territories, and tribal governments. Examples include Community Development Block Grants from HUD or the Child Care and Development Fund from the Office of Child Care under HHS. States must coordinate their own programs, and must submit comprehensive plans regularly to overseeing federal agencies.

Additionally, each state runs its own unemployment insurance program; during the coronavirus pandemic, this was made apparent when some states ended unemployment benefits before others did.

The Role of the Private Sector

The social safety net is considered to be a public benefit, but the private sector is also heavily involved. Through most block grant programs, states and municipalities contract with private providers to provide goods and services. Terms and conditions for TANF, for example, lists nonprofit institutions, educational institutions, and commercial vendors as potential subcontractors for states and territories. In the case of Child Care Services from the Child Care and Development Block Grant, for example, parents can choose “a participating child care provider that satisfies applicable state and local requirements.”

Even more private sector actors participate without contracting with the government. Some business models have incorporated charitable giving, such as those that provide clothing or meal donations with every purchase. While perhaps unable to solve all problems of need and poverty alone, nonprofit organizations and charities will continue to play an important role in assisting the most vulnerable by capitalizing on the remarkable charitableness of Americans. See The Policy Circle’s Strategic Philanthropy & Strategic Giving Brief for more on U.S. charitable giving.

Challenges & Areas for Reform

As reforms become increasingly unavoidable, the goal is to make sure important programs are sustainable for younger generations, while not making changes for those on the cusp of or already in retirement.

Effectiveness & Efficiency of Programs

Some argue that government assistance programs suffer from duplication and overlap across agencies, which cause inefficiencies and waste. In 2019, states and territories improperly paid $2.85 billion in unemployment insurance. The national improper payment rate was 10.61% in 2019 and 9.17% in 2020, though percentages vary by state. In 2019, the SNAP payment error rate increased to 7.3%, up from 6.8% in 2018 and 6.3% in 2017. For more on these and other programs, see The Policy Circle’s Poverty Brief.

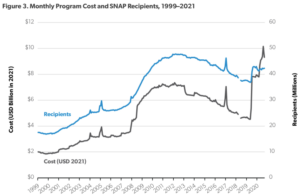

One major issue is how to measure the success of the various assistance programs. AEI’s Angela Rachidi notes that, for the most part, SNAP benefits have benefited the health and well-being of children and families. The tricky part of this analysis is that the number of participants by itself is not a reliable benchmark of success. A USDA Economic Research Service study found SNAP participation increased by 2-3 million people for every 1 percentage point increase in the unemployment rate during the Great Recession, meaning it is effective in helping those in need. However, decreases in participation lag behind improvements in the employment rate, as demonstrated in the graph below. Some argue this is because SNAP benefits disincentivize work.

Work incentives are another piece of the government assistance puzzle. Those in favor of work requirements argue that requirements incentivize individuals to help themselves instead of leaving them dependent on the government. Those who oppose work requirements fear people in need will lose coverage if they can’t meet such requirements or will be precluded from registering due to bureaucratic hurdles.

TANF is a good example. President Bill Clinton incorporated work requirements in the TANF welfare program in 1996. Twenty-five years later, the effects of those work requirements are still heavily debated. After the 1996 reform, income rose for single mothers and short-term employment rates improved. Surveys on long-term and extreme poverty measures were not positive, but Robert VerBruggen of the Manhattan Institute argues those kinds of income surveys do not tell the whole story and tend to miss other distributed government benefits. These benefits are better captured in effects on consumption, measuring how much people are buying. The 1996 reform was followed by “broad and consistent increases in consumption,” particularly among single mothers.

Other analysts point to a different aspect of the long-term poverty measurements. According to research from the Center on Budget and Policy Priorities, 23 out of every 100 families with incomes below the federal poverty line receive TANF benefits, compared to 68 out of every 100 families before the reform. The researchers found this decrease was mainly due to fewer families participating in the program despite needing assistance; they argue recipients who left TANF for work ended up “in jobs characterized by periods of joblessness and below-poverty incomes.” Only 21% of the decrease was from fewer families needing assistance.

Some experts argue the coronavirus pandemic has only further demonstrated the inadequacy of U.S. safety net programs. The consequences of mass unemployment in terms of loss of income, loss of access to health insurance, and disruption of public services have hit many citizens hard. Even with programs such as TANF, SNAP, SSI, and unemployment insurance, benefits are low and compliance requirements make applying difficult. In the case of unemployment insurance, claims prompted by pandemic-induced layoffs quickly overwhelmed offices, leaving many without the timely help they needed.

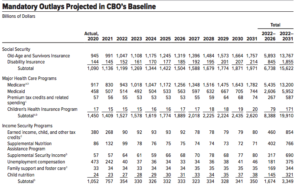

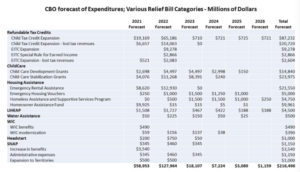

The 2021 COVID-19 Relief Bill (American Rescue Plan Act) extended 8 of 13 safety net programs. For example, the Child Care program was expanded beyond low-income households to anyone with economic hardship from COVID-19. In 2019, the government spent $8.3 billion on the Child Care program block grants; the relief bill added $38.3 billion. The Act also expanded housing assistance funds, such as for housing vouchers and homeless shelters. In 2019, HUD spent $60 billion on housing assistance; the relief bill added $41.3 billion. See a full list and forecast of added expenditures, using data from the Congressional Budget Office (CBO), in the chart below.

On the one hand, reported hardship rates declined after the stimulus payments in December 2020, after the American Rescue Plan stimulus payments in March 2021, and after the expansion of the Child Tax Credit and additional food assistance in July 2021.

This positive impact has led some to argue that income support – a guaranteed minimum income, or cash transfers – could replace the maze of existing government assistance programs. Others argue this could create disincentives to work, and there needs to be more research before anyone can determine whether this would generate cost savings. A big component of that determination would revolve around who should get such income support, or what an eligibility cutoff would be.

This is why the Biden Administration’s Build Back Better plan is generating controversy. The plan includes universal preschool, expanded tax credits, and expanded health benefits, among many other benefits. Allison Schrager of the Manhattan Institute argues expanding benefits for citizens “is an open-ended commitment to spending every year, and one that…is very difficult to take away.” Such programs can affect people’s decisions on work, education, consumption, and overall participation in the economy.

The general dilemma boils down to how best to meet the needs of the nation, while taking into consideration how broadly benefits should be offered, whether programs will make individuals dependent on government support, and total federal spending. For example, in the realm of healthcare, millions of Americans lost coverage when they lost their jobs at the height of the pandemic. Broadening government-funded healthcare to a fully public option would cover these individuals, but it would also “include the need to massively restructure nearly one-fifth of the U.S. economy and roughly double government spending and taxation.”

Social Security

Social Security is the largest single program in the federal budget. The CBO predicts the number of Social Security beneficiaries will rise from 64 million in 2019 to 97 million in 2049, and that spending will rise from 4.9% of GDP to 6.2% over this time period. America’s aging population accounts for practically all the predicted spending growth in Social Security.

Because “automatic” government assistance programs (entitlements) are funded year to year, these programs do not receive the same level of oversight as the fiercely debated discretionary programs. The WSJ Editorial Board explains, “Entitlements that spend automatically based on eligibility are nearly impossible to repeal, or even reform, and they represent a huge tax-and-spend wedge far into the future.”

Estimates from an August 2021 report from the Social Security and Medicare Boards of Trustees states the Board expects reserves to be depleted by 2034, one year sooner than estimated in April 2020. Slowed population growth, mortality rates, worker productivity during the pandemic, higher inflation, and reduced payroll tax revenue have impacted trust funds.

By law, federal trust fund spending cannot exceed revenue once reserves are depleted. This means beneficiaries will see cuts in their benefits. For example, the Social Security Old Age and Survivors Insurance Trust Fund (separate from the Disability Insurance Trust Fund) is on pace to be depleted in 2032. At that point, benefits will be cut by 27% (about $7,000 cut in annual benefits) with increasing cuts to benefits each following year.

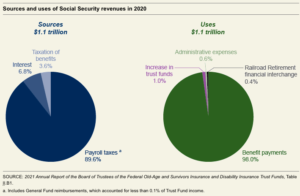

Why is there a spending-revenue mismatch? The current benefit formula has benefits growing faster than revenues because there has been a decline in the number of workers relative to beneficiaries. This is due to the large number of retiring Baby Boomers, and longer life expectancies, meaning they will receive benefits longer than previous generations. Today, fewer than three workers are paying for each beneficiary, versus more than 16 workers per beneficiary in 1950. The payroll taxes that fund Social Security, known as FICA taxes, stand at 6.2% (the employer pays a tax equal to the amounts withheld from employee earnings, for a total of 12.4%). This rate does cover the costs of benefits that are paid out.

Payroll taxes can also be a disincentive to work because workers, particularly millennials, are not confident they will receive their full Social Security benefits and thus see taxes paid as a loss. This is contrasted with their 401(k) contributions that they view as deferred income and an investment they will eventually be able to access. Today, money is paid from your paycheck to a current beneficiary. With an increase in Baby Boomer retirees and decrease in workers, this becomes a non-self sustaining financing system. The Policy Circle’s Aging in the 21st Century Brief dives deeper into the issues of aging demographics.

Social Security is on its way to insolvency, which will impact overall government debt and potentially threaten the federal budget meant for other needs. The goal is to restore fiscal balance, but whether this should be through tax increases, benefit reductions, or some combination thereof, is heavily debated.

Social Security is on its way to insolvency, which will impact overall government debt and potentially threaten the federal budget meant for other needs. The goal is to restore fiscal balance, but whether this should be through tax increases, benefit reductions, or some combination thereof, is heavily debated.

An analysis by Urban Institute looked at two plans to balance Social Security revenue and spending.

Option 1: Expand Social Security:

- Increase payments and cost-of-living adjustments for beneficiaries

- Increase the payroll tax rate to offset increased benefits

Those in favor of expanding Social Security note that the current benefit formula still leaves many beneficiaries with income below the federal poverty level; according to the analysis, this plan could lift 2.6 million adults out of poverty (when compared to benefit trajectories based on current law). The downside would be the increase in taxes to pay for this expansion.

Option 2: Shrink Social Security

- Raise the retirement age and reduce payments for high-lifetime earners

- Increase payments for low-lifetime earners and eliminate federal income taxes on benefits

Urban’s analysis found this plan would lift 800,000 adults out of poverty, but it would target those in the lowest income percentiles. Supporters of reining in Social Security argue benefit formulas that target those in need are better than blanket expansions that may give money to those who are not in need. They argue this will reduce individual’s dependency on the government, and that smaller programs are easier to manage and less likely to result in out-of-control spending that is common among mandatory spending programs.

Despite being very different methods, both plans would balance Social Security finances and eliminate the long-term funding shortfall. Restoring balance is possible, but policymakers have not been able to agree on the road to get there.

See this interactive feature for how different reform proposals could affect the future of Social Security.

Medicare

In 2019, the U.S. spent 17.7% of GDP on healthcare, which included Medicare, Medicaid, CHIP, and Affordable Care Act subsidies. This increased to 19.7% of GDP in 2020. Medicare alone accounts for 20% of all national health spending. As the population ages, more Americans will qualify for Medicare, which is already straining against fiscal challenges.

Experts have long pointed to the healthcare system’s waste, estimating about 30% of total healthcare spending goes to unnecessary, ineffective, or overpriced services. This does provide many opportunities for lowering costs. See The Policy Circle’s Health Care Brief for more of these reform ideas.

The Medicare Part A (hospital insurance) trust fund is expected to be depleted in 2026, at which point benefits will be cut by 13%. Cuts will increase in the following years. Medicare Parts B and D (physicians and prescription drugs, respectively) are the largest drivers of the shortfall, and are legally allowed to run deficits without cuts in benefits. Additionally, the aging of the Baby Boomer Generation means total Medicare spending – which came to $689 billion in 2021 – is estimated to more than double in the next decade, from $700 billion in 2022 to $1.6 trillion per year by 2032.

The Council on Affordable Health Care estimates the cumulative Medicare Hospital Insurance Trust Fund deficit will reach somewhere between $500 billion and $700 billion by 2030 (and potentially $900 billion if there is higher-than-expected spending). The Congressional Budget Office estimates a 1% increase in payroll tax rate, or a spending cut of 2% annually, could recoup nearly $1 trillion over the next decade, offsetting this shortfall. The difficult part is enacting these changes: “in the midst of a pandemic and economic downturn, hospital payment cuts, tax increases, or any efforts to shift costs to Medicare beneficiaries would be even more politically challenging than usual.”

TheTrustees of the Social Security and Medicare trust funds 2021 report says that 2021 was the fifth consecutive year in which annual revenues “will be below 55 percent of projected combined annual outlays within the next seven fiscal years.” Two consecutive years of this constitute a “‘Medicare funding warning.’”

Conclusion

As currently structured, social safety net programs are running out of funding even while struggling to meet the needs of Americans. With ballooning spending, most experts agree choices for welfare and entitlement reform boil down to either ending investments in other crucial social priorities, allowing entitlement programs to collapse, or running up the federal debt. Understanding the fundamental problems with the social safety net programs is the key to deciding which avenue for reform will be most effective in ensuring the wellbeing and self-sufficiency of Americans for generations to come.

Ways to Get Involved/What You Can Do

Measure: Find out what your state and district are doing about social safety net programs.

- Do you know the state of poverty, social security, or health care in your community or state?

- How much does your state spend on safety net programs? How many beneficiaries are there?

- Do you know the demographics of your community, or median income levels?

- Ballotpedia has economic, social, legal, and demographic immigration information on a state-by-state basis.

- Is there a coalition or task force addressing welfare, social security, health care, or even COVID-19 related safety nets, or does one need to be formed?

Identify: Who are the influencers in your state, county, or community? Learn about their priorities and consider how to contact them, including elected officials, attorneys general, law enforcement, boards of education, city councils, journalists, media outlets, community organizations, and local businesses.

- Who heads the Department of Human Services in your state?

- Who are contacts for program agencies, such as SNAP, TANF, or unemployment insurance?

- Who are the members of (coalitions, boards, etc.) in your state?

- What steps have your state’s or community’s elected and appointed officials taken?

Reach out: You are a catalyst. Finding a common cause is a great opportunity to develop relationships with people who may be outside of your immediate network. All it takes is a small team of two or three people to set a path for real improvement. The Policy Circle is your platform to convene with experts you want to hear from.

- Find allies in your community or in nearby towns and elsewhere in the state.

- Foster collaborative relationships with: faith-based organizations, local hospitals, community organizations, school boards, and local businesses.

Plan: Set some milestones based on your state’s legislative calendar.

- Don’t hesitate to contact The Policy Circle team, communications@thepolicycircle.org, for connections to the broader network, advice, insights on how to build rapport with policy makers and establish yourself as a civic leader.

Execute: Give it your best shot. You can:

- Look at your pay check to see what taxes are being taken out, and what they go towards.

- Consider the workforce in your community and place of employment; does it include adults over the age of 65?

- Keep an eye on legislation related to social safety net programs in your state.

- Explore Social Security reform options with this interactive reformer tool, from the Committee for a Responsible Federal Budget.

- Take a look at applications for programs such as SNAP, TANF, or unemployment insurance to understand compliance requirements.

Working with others, you may create something great for your community. Here are some tools to learn how to contact your representatives and write an op-ed.

Additional Resources

- Quick facts on Safety Net Programs and Welfare, from Federal Safety Net

- Government Spending tracker

- Poverty statistics map, from Spotlight on Poverty

- Options to secure Medicare and Social Security, from the Committee for a Responsible Federal Budget

Suggestions for your Next Conversation

Explore the Series

This brief is part of a series of recommended conversations designed for circle's wishing to pursue a specific focus for the year. Each series recommends "5" briefs to provide a year of conversations.