What You Need to Know About Illinois Healthcare

- Illinois’ population is 12.8 million

- Labor force participation in Illinois is 64.4 percent of the population. It was 69 percent in 2000.

- The distribution of healthcare coverage in Illinois based on the Census Bureau’s March 2014 and reported by the Kaiser Family Foundation:

- 58 percent are covered by employer provided health insurance or other form of private insurance.

- 17 percent by Medicaid including children’s insurance program (over 2.5 million people).

- 13 percent by Medicare including those covered under the military or Veterans Administration as well as nonelderly Medicare enrollees.

- 11 percent are uninsured.

- The Illinois State Budget Fiscal Year 2016 financial summary recommended that the state spend:

- 31.5 percent of all funds ($19.2 billion) on healthcare, which compares to:

- 25.7 percent of all funds ($12.2 billion) on education,

- 7.6 percent of all funds ($3.1 billion) on public safety

- 2.6 percent of funds ($4.3 billion) on economic development efforts.

- Consider that the national average for spending on healthcare (Medicaid and Children’s Health Insurance Program) is 16 percent.

- Let’s also remember that as of March 2015, the state had $111 billion in pension debt and more than $6 billion in unpaid bills. (IL Budget)

How We Compare

The following data is derived from the Commonwealth Fund’s (a center-left think tank) Scorecard on State Health System, 2014. This study evaluated states based on 42 different criteria regarding healthcare across the nation in 2007-2012.

| STATE | OVERALL HEALTH SYSTEM RANKING | ACCESS RANKING | PREVENTION & TREATMENT RANKING | AVOIDABLE HOSPITAL USE & COST RANKING | |

| Illinois | 26 | 24 | 23 | 39 | |

| TOP 5 STATES | Minnesota | 1 | 3 | 6 | 7 |

| New Hampshire | 2 | 5 | 3 | 12 | |

| Vermont | 2 | 4 | 8 | 11 | |

| Massachusetts | 2 | 1 | 1 | 30 | |

| Hawaii | 5 | 14 | 20 | 1 | |

| BOTTOM 5 STATES | Nevada | 46 | 48 | 51 | 19 |

| Alabama | 46 | 33 | 38 | 47 | |

| Louisiana | 48 | 39 | 41 | 50 | |

| Oklahoma | 49 | 37 | 45 | 45 | |

| Arkansas | 50 | 49 | 50 | 37 | |

| Mississippi | 51 | 46 | 45 | 50 |

“The Commonwealth Fund is a private foundation that aims to promote a high performing healthcare system that achieves better access, improved quality, and greater efficiency, particularly for society’s most vulnerable, including low-income people, the uninsured, minority Americans, young children, and elderly adults.”

The U.S. Department of Health and Human Services’ National Healthcare Quality and Disparities Report (NHQR) measures Illinois compared to the average of all states on a number of metrics. Compared to all states for the most recent data year, the performance for all Illinois measures is in the “Average range” on topics, such as patient safety, care coordination, effective treatment, care affordability, and general access to care.

In addition, Americas Health Rankings, which is an annual assessment of the nation’s health on a state by state basis and is a partnership between United Health Foundation, American Public Health Association, and Partnership for Prevention, gives Illinois an overall ranking of 30 in their healthiest states findings (Hawaii first, Mississippi last) and provides the following highlights:

- Illinois has a ready availability of primary care physicians.

- Illinois has a ready availability of dentists.

- Illinois has a low occupational fatalities rate.

- In the past year, physical inactivity increased by 8 percent from 21.8 percent to 23.6 percent of adults.

- In the past year, immunization coverage among adolescents increased by 20 percent from 55.4 percent to 66.3 percent of adolescents aged 13 to 17 years.

- In the past year, preventable hospitalizations decreased by 11 percent from 73.1 to 65.2 per 1,000 Medicare beneficiaries. However, Illinois still ranks 40th among states.

- Since 1990, infant mortality decreased by 45 percent from 11.9 to 6.5 deaths per 1000 live births.

What the Affordable Care Act did to Illinois

When analyzing healthcare policy in the states, one must consider the impact that the Affordable Care Act (ACA) has on the healthcare debate. A 2015 report released by the American Action Forum articulates how the ACA changed the American healthcare system. The authors, Tara O’Neill and Conor Ryan, state that the “primary objectives of the ACA were to expand insurance coverage while reducing the cost of insurance, and to rein in the increasing cost of healthcare. Whether these goals are being achieved and at what cost to the budget and to the healthcare stakeholders are important considerations.”

The ACA aimed to reduce Illinois’ 1.3 million eligible, uninsured adult population by half by the end of March 2014. The state met only 50% of its goal with only one-quarter of the eligible uninsured receiving coverage. Federal taxpayer funds for “outreach” and marketing of ACA in Illinois totaled almost $155 million. When the state’s share of the potential $832 million tab for the federal ACA website is included, federal taxpayers spent more than $1,000 in “acquisition” costs for every previously uninsured Illinoisan who obtained private health insurance through the health insurance exchange.

The ACA placed two significant policy pressures on states:

1. Establish a Health Insurance Exchange (or Marketplace) for its citizens to

shop for health insurance

2. Expand Medicaid.

Because it is impossible for a state’s healthcare system to be unaffected by the ACA, many aspects of the law, such as Medicaid expansion and the Cadillac tax, will be discussed in relation to Illinois policy in coming sections.

How ACA Offers Coverage: Health Insurance Exchange

A state may establish its own health insurance exchange, work in partnership with the federal government, or allow the federal government to run its Marketplace completely. Illinois chose to work in partnership with the federal government in order to run its Marketplace and uses the website Get Covered Illinois as a portal for insurance information and access. Illinois residents are directed to HealthCare.gov to register for coverage or are directed to the state’s online application system for Medicaid coverage and other income assistance. Illinois was one of 14 states to set up a State-Partnership Marketplace.

The Effect of “One Size Fits All”

The Minimum Essential Coverage (MEC) is the type of coverage an individual needs to have to meet the individual responsibility requirement under the Affordable Care Act. If that coverage is not met, individuals will have to pay a penalty.

Having a federally mandated minimum coverage that includes prescription drugs and pregnancy coverage does not allow for flexible plans tailored to the needs of the individuals and their families—the result is a one size fits all coverage at a higher premium cost. With fewer coverage choices and consistently rising premiums, the ACA has become increasingly unpopular with Americans. In a recent CNN poll, 55 percent opposed the all-encompassing healthcare system, while 43 percent supported it.

Nathan Nascimento, senior policy advisor at Freedom Partners Chamber of Commerce, opines in The Hill that States are more competent, more responsive and more flexible than Washington, D.C. State lawmakers are also better equipped than federal bureaucrats to understand and address their constituents’ healthcare needs. Every state is different with unique circumstances, from Connecticut to California and Alaska to Alabama.

What the Supreme Court Says: King v. Burwell

As described by Jeffrey Schwab, a staff attorney with the Liberty Justice Center, “After the passage of the Affordable Care Act, or ACA, the IRS adopted a rule that allows the federal government to issue tax credits to individuals in states which have set up their own health-insurance exchanges as well as individuals in states which have not set up their own health-insurance exchanges and get health insurance through the federal exchange. The problem is that the ACA only authorized tax credits for the purchase of insurance in exchanges ‘established by the State.’ In King v. Burwell, the plaintiffs challenged the IRS rule because it directly contradicts the text of the ACA.”

In a 6-3 decision, the Justices held that the IRS can continue to offer subsidies to ACA buyers in all fifty states, contrary to what Section 1401 of the Affordable Care Act says. Dr. Betsy McCaughey, a former Lt. Governor of New York is chairman of Reduce Infection Deaths and a senior fellow at the London Center for Policy Research. Dr. McCaughey states, “The ruling puts a stamp of approval on IRS discretion to change provisions of the health law. The U.S. Constitution charges Congress with making the laws and the president with seeing that they are ‘faithfully executed.’” Read her editorial for another perspective.

How the Employer Mandate is Killing Jobs

The employer mandate provision of the ACA will become more prominent as its threshold applicability affects more employers. The mandate currently requires employers with 100 or more full-time employees to give “qualified and affordable” health insurance to their workers. Beginning in 2016, the law will apply to employers with 50 or more employees. Critics of the provision show that it impedes employment progress in the state of Illinois, and recent data suggests that employers have begun trimming their employment rolls and hours worked to avoid one of the most expensive obligations of ACA.

Naomi Lopez Bauman of the Illinois Policy Institute reports that the state’s lowest-paid and lowest work hours sectors, including retail trade, food and beverage, and general merchandise, now have average work hours of less than 30 hours per week, the level in which an employee is deemed “full-time.” Prior to the ACA, these areas’ work hours remained consistent, and even increased in some years. Since the enactment of the ACA, however, all three exhibited much lower hours. These reductions have drastic consequences on the state. The work hour cuts in retail are the equivalent of around 28,000 Illinois jobs lost since 2011; cuts in the foodservice industry are equivalent to another 28,000 lost jobs; and cuts in general merchandise equates to 7,000 lost jobs. The state has lost the corresponding value of approximately 63,000 jobs because of hourly cuts since 2011.

How to Reform the Affordable Care Act

In February of 2015, Chairman Orrin Hatch of the Senate Finance Committee, Senator Richard Burr, and Chairman Fred Upton of the House Energy and Commerce Committee introduced a legislative plan that proposed a replacement to the ACA. Titled the Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act, the plan would repeal the ACA and focus on principles such as patient protection, small business safeguards, state authority enforcement, and consumer-directed markets. The proposal, among other reforms, would (1) ensure patients could not be denied health insurance due to a pre-existing condition if they were consistently covered; (2) supply specific consumers with tax subsidies to help them purchase coverage; (3) give states more power, such as allowing them to join interstate agreements; (4) use personal health insurance accounts such as Flexible Spending Accounts and Health Savings Accounts; and (5) make health plans and funding more personalized. The United States Senate Committee on Finance website presents a two-page summary and comparison of the bicameral legislation.

Senator Bill Cassidy of Louisiana, as described in a guest editorial to The Hill, urges his colleagues to eliminate the tax subsidies currently under the ACA and give tax credits to employees not receiving premium assistance from their employer-based healthcare or from Medicaid. He proposes that the credits go directly to the patient in the form of a Health Savings Account to provide more flexibility than what is allowable under the current ACA subsidies.

A number of other proposals from Senators, Congressmen, think tanks, and other intellects have been introduced to replace the ACA. Additional commentary may be found from Edmund F. Haislmaier of the Heritage Foundation, Josh Winthrow of FreedomWorks, Paul Howard of the Manhattan Institute, or elected officials such as Governor Bobby Jindal of Louisiana through his think tank, American Next., Governor Scott Walker, or Senator Marco Rubio.

Medicaid, CHIP (All Kids) and ACA: The Path to Dependency

Medicaid was established 50 years ago to provide health insurance to citizens unable to afford private coverage. Illinois’ Medicaid program is funded by the federal and state governments, and managed by the state. Along with the federal government, states fund health insurance for low-income families through Medicaid and the Children’s Health Insurance Program (CHIP). (Illinois CHIP program is called All Kids). In a typical month, these programs provide health coverage or coverage for long-term care to roughly 70 million low-income children, parents, elderly people, and people with disabilities. Together they constitute about 16 percent of state budgets, or about $183 billion. States spend the remaining half of their budgets on a wide variety of programs.

The Federal government contributes to the state share of Medicaid spending through what is called the Federal Medical Assistance Percentage. The Federal Medical Assistance Percentage (FMAP) is computed from a formula that takes into account the average per capita income for each state relative to the national average. By law, the FMAP cannot be less than 50 percent in any state. Illinois’ FMAP is 50.8 percent.

The ACA induces states to extend Medicaid benefits to those making up to 138 percent of the federal poverty level. Illinois opted to expand, and increased the state’s Medicaid population by approximately 500,000. The federal government is currently covering nearly 100 percent of the costs associated with these new 500,000 enrollees, most of whom are “able-bodied adults.” In 2020, however, the federal government will be obligated to pay only 90 percent.

While there is no single Medicaid appropriation in the Illinois state budget and the program operates from multiple agencies (primarily from Department of Healthcare and Family Services), the Medical Assistance spending by the Department of Healthcare and Family Services provides a good approximation of total Medicaid spending in the state. This totals approximately $19 billion in the proposed fiscal year 2016 budget.

In order to qualify for Medicaid, a person must be a resident of the state of Illinois, a U.S. national, citizen, a permanent resident, or a legal alien, in need of healthcare/insurance assistance, whose financial situation would be characterized as low income or very low income. A person must also be either pregnant, a parent or relative caretaker of a dependent child(ren) under age 19, blind, have a disability or a family member in your household with a disability, or be 65 years of age or older.

- Because Illinois has expanded Medicaid under the ACA, Illinois residents up to 138% of the federal poverty level are now eligible for Medicaid.

- Over the last 10 years, in 2015, Medicaid enrollment surged 68% to cover 3.2 million people.

- In 2011 according to the Kaiser Family Foundation, people enrolled in Medicaid in Illinois are:

- 17 percent Aged 65 and older)

- 40 percent People with a disability

- 43 percent Adults ages 19-64

- 25 percent Children 18 and younger

- In 2011 according to the Kaiser Family Foundation, people enrolled in Medicaid in Illinois are:

States vary regarding the authority they have to adjust their Medicaid programs. Some governors have the ability to make program decisions without the approval of their legislature. Some legislatures must authorize potential changes. Finally, states must negotiate most plan decisions through a Medicaid State Plan Amendment or waiver process with Federal government’s Centers for Medicare and Medicaid Services (CMS).

A Program of Government Dependency

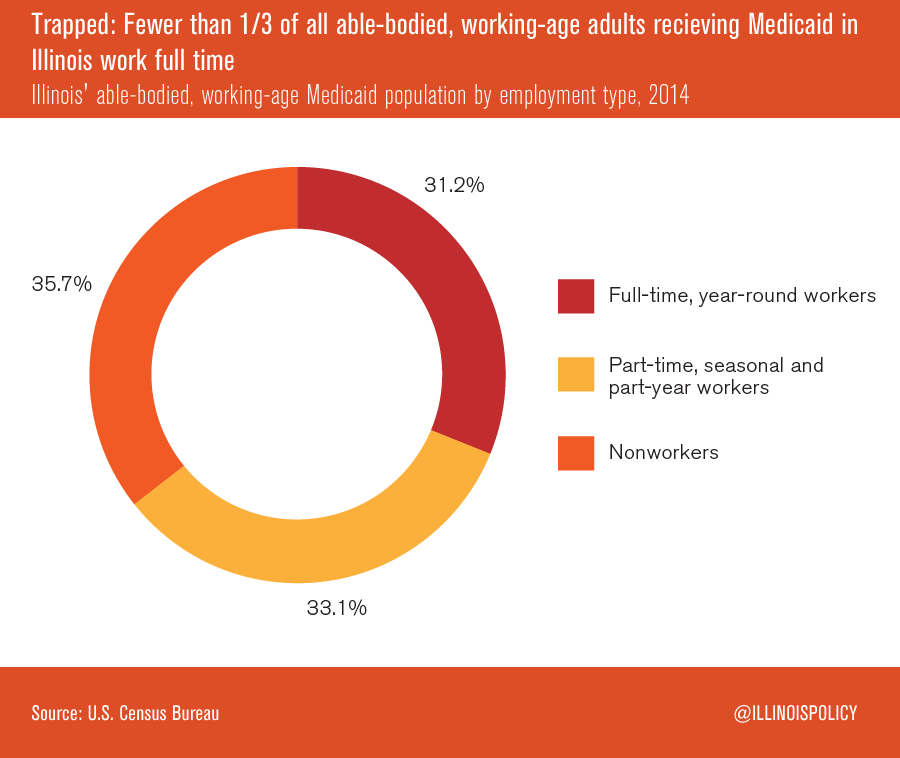

According to a report written by Austin Berg, a writer for the Illinois Policy Institute, less than one-third of all able-bodied, working-age adults receiving Medicaid in Illinois are working full-time, year-round jobs. Only 31% work part-time, part-year, or seasonally, and 36% of recipients do not work at all.

Many argue that recipients of Medicaid and social welfare need employment more than welfare benefits, particularly as the Medicaid benefit structure disincentives them to earn more income. A single mom has the most resources available to her family when she works full time at a wage of $8.25 to $12.00 an hour in Illinois. Taking a pay increase to $18.00 an hour can leave her with about one-third fewer total resources (net income and government benefits). In order to make work “pay” again, she would need an hourly wage of $38.00 to mitigate the impact of lost benefits and higher taxes.

The potential sum of welfare benefits can reach $47,894 annually in Illinois for single-parent households and $41,237 for two-parent households. Welfare benefits will be available to some households earning as much as $74,880 annually.

Some Medicaid recipients are discouraged from finding better paying work, as the system creates “unnecessary barriers to self-sufficiency.”

Fee for Service = Disparity

Approximately 50% of Medicaid enrollees in Illinois are in a “fee for service” program, which reimburses health providers at a predetermined rate for certain services. As the reimbursement rates are low and the payment processing time is long, many doctors do not accept Medicaid patients or cap the number they accept. As a result, many individuals on Medicaid experience long wait times to receive medical treatment. Nationally, children on Medicaid are six times more likely than their privately insured counterparts to be rejected for a specialist appointment.

What? Fraud in Illinois?

The U.S. Government Accountability Office labeled the Illinois Medicaid program as “high risk”. In 2010, the Illinois Department of Healthcare and Family Services investigated the state’s method of checking for fraud, which included asking Medicaid recipients to self-report upon becoming ineligible. The investigation found that 34 percent of the files that were randomly selected were fraught with eligibility mistakes. By 2012, the program was swamped with a $2.7 billion structural deficit. Consequently, the Department ordered a restructuring of the eligibility determination process, and the Illinois Medicaid Redetermination Project was born.

Through the Project, an independent vendor was hired to check for fraud, and, in the first two years, 700,000 enrollees were discharged, representing over 10% of the state’s entire Medicaid population disenrolled each year. The project expects to save taxpayers hundreds of millions of dollars per year. Despite the program’s success, however, former Governor Pat Quinn met opposition from the American Federation of State, County, and Municipal Employees (AFSCME), who contended that state workers should have the duties to review Medicaid cases rather than a private vendor. Governor Quinn signed an agreement with AFSCME, directing the vendor and state authorities to share duties for detecting eligibility fraud. Now, eligibility is checked only once annually, and the many recipients who become ineligible throughout the year go undetected because the median length of time people live in poverty is only 6-7 months as reported by the US Census Bureau.

Governor Rauner’s proposed budget would reduce Medicaid general funds by 18.9%. The proposed savings are derived primarily from reinstating many of the original Medicaid reforms that were part of the original Save Medicaid Access and Resources Together Act that passed on a bipartisan basis in 2012 and included eligibility verification measures. Under the ongoing budget discussion, the state would need to find approximately $10 in cuts in the new enrollee population to save just $1 in spending. Only $2 would need to be cut in the pre-expansion population to save $1 in spending. Consequently, the more needy population may be more at risk for benefit reduction when Medicaid funding is cut in the 2016 budget.

Some notes about eligibility:

- The Federal Poverty Level is $11,770 for a family of 1 (add $4,160 for each additional family member – that is $24,250 for a family of 4)

- If a person makes between 100 percent and 400 percent of the Federal Poverty Level, he or she may qualify for premium tax credits on the Health Insurance Marketplace—that is between $23,850 and $95,400 for a family of 4.

- If a person make less than 138 percent of the Federal Poverty Level and their state expanded Medicaid, he or she may qualify for Medicaid or CHIP—that is $32,913 for a family of 4.

- If a person makes between 100 percent and 250 percent of the Federal Poverty Level, he or she may qualify for out-of-pocket cost assistance on Silver plans sold through the Marketplace—that is up to $60,625 for a family of 4.

How to Reform Medicaid

The Illinois Policy Institute recommends the implementation of “premium assistance models,” which make Medicaid enrollees responsible for a portion of the premium and health insurance savings accounts. With more independence and flexibility provided by the health savings account, Medicaid enrollees would be incentivized to direct healthcare choices better suited to their needs. After these individuals purchase insurance, any funds remaining in the health savings account could cover miscellaneous costs, such as copays and prescriptions. The most needy patients could be given full subsidies that would slowly decrease as they became able to pay for portions of their services. The report estimates that a premium assistance model would save the state over $1 billion per year. This practice is evident in other states, such as Indiana’s HIP 2.0 program.

With regard to the state’s decision to expand Medicaid, Drew Gonshorowski, Senior Policy Analyst at the Heritage Foundation, notes the possibility of the federal government retracting its pledge to always pay 90% of costs for the expansion population. If such assistance is reduced, the state should be ready and willing to roll back the expansion. Many oppose federal Medicaid expansion in general for two main reasons:

- It extends taxpayer dollars to more childless, able-bodied adults; and

- Policymakers should fix the already-strained Medicaid system instead of growing it.

Florida in particular has been retroactive in reforming its Medicaid program without accepting federal enticements to expand it. Under the leadership of then-Governor Jeb Bush, the state implemented a Medicaid Cure reform pilot. A Florida-based think tank, The Foundation for Government Accountability, initiated the plan. The plan emphasizes a “pro-patient, pro-taxpayer” policy, and has seen high levels of satisfaction from its recipients. From 2006-2014, Florida taxpayers saved $118 million when the program was operating in 5 counties. Now that the program has been implemented throughout the state, researchers estimate the total taxpayer savings will amount to nearly $1 billion. Other states soon followed, including Kansas and Louisiana. If “Project Medicaid Cure” was implemented across the country, it could save Medicaid programs up to $28.6 billion per year.

To reduce fraud, Jonathan Ingram of the Illinois Policy Institute suggests in a report that the state should implement more frequent eligibility checks by beginning with the cases that are the highest-risk and working down from there. According to state officials, checking for fraud twice a year instead of the once a year current policy could save taxpayers an additional $225-$250 million a year.

State Employee Health Insurance

How State Employees Get More by Paying Less

Health insurance for state employees currently accounts for $3 billion of the state’s budget as discussed by Naomi Lopez Bauman of the Illinois Policy Institute. Most of these plans are generous with no deductibles, and the employees pay approximately 17 percent of the cost of their coverage. Comparatively, employees in the private sector pay 29 percent more for individual coverage and 53 percent more for family coverage than state workers. In 2013, 80 percent of state employees’ plans had a $0 deductible, but 85 percent of private sector employees were covered by plans with a deductible, the average of which was $1,301 for individual coverage and $2,584 for family coverage. State employees not only pay less for insurance plans, but the plan quality is superior.

In 2013, the most common plan for state employees paid a greater sum of medical expenses than all of the plans that are now accessible on the Illinois ACA Marketplace. Additionally, the average state employee insurance plan’s “actuarial value,” the scope of medical expenses the plan covers, is greater than the best plan on the Marketplace. The following graph illustrates a real-world application of the discrepancies between public and private health insurance plans.

The Affordable Care Act, Budget, and Cadillac Tax

A significant provision of the ACA, the Cadillac Tax, is scheduled to become effective in 2018. This provision imposes a 40 percent excise tax on employer plans with values over $10,200 for an individual plan and $27,500 for a family plan. In Illinois, this would directly impact the state employee health insurance plans, as they are more generous than private sector health insurance in the state. The value of some health insurance plans for Illinois’ active state employees and their dependents is so generous that it could trigger $2 billion in Cadillac taxes over the next 20 years. That would be in addition to the $1 billion for retiree health insurance.

Governor Rauner’s proposed budget reduces these plans and the State Group Health Insurance Program’s funds by $700 million. Despite the proponents of budget cuts, state workers have responded with a vigorous call to maintain funding levels, claiming the governor’s proposal would expose lower-paid state workers to harm, as currently, lower-paid employees pay less for health insurance than higher-paid employees. Under the governor’s proposal, all state employees will pay equal amounts for group insurance.

How to Reform State Employee Health Insurance

The Illinois Policy Institute sets forth a policy recommendation for the state to accommodate the impact of the Cadillac tax by looking to private-sector employers. Many private employers have begun to offer less generous health insurance to their employees to avoid the full effect of the impending tax or having the insured employees absorb the costs. The report proposes Illinois follow this example by reducing the coverage of state employees to a level similar to the Marketplace’s “silver” tier health insurance.

Certificate of Need Laws: What Are They and Are They Needed?

In 1974, the federal government began requiring every state to implement a review procedure for expensive projects at health-care facilities to ensure public funds were not being used for unnecessary expenditures. This review came to be known as the Certificate of Need (CON) process. Over time, the state boards issuing CONs became rife with manipulation by administrators granting certificates to powerful institutions and eliminating their competition. Illinois is no exception. Although the federal law was repealed, Illinois and 35 other states maintain CON laws. Hospitals, long-term care facilities, birthing centers, and other healthcare establishments not owned by the federal government are subject to the jurisdiction of these laws, and their major capital projects require a Certificate of Need before proceeding. The Illinois Health Facilities Planning Board reviews healthcare facilities in the state and administers the CON program.

A 2011 report by the National Institute for Health Care Reform examined the CON procedure in six states, including Illinois. The report states, “In five of the six states studied—all except Michigan—the CON approval process can be highly subjective and tends to be influenced heavily by political relationships rather than policy objectives. . . Certificate-of-need programs tend to be influenced [by] a provider’s clout, organizational size, or overall wealth and resources. . .” The Illinois board has a history of corruption, including the arrest and indictment of former Illinois Governor Rod Blagojevich and the board’s former vice chairman.

How to Reform Certificate of Need Laws

Many organizations openly oppose the CON laws, including the Federal Trade Commission, the Department of Justice, the American Medical Association, and the Illinois State Medical Society. They maintain that CONs hurt consumers, innovation, newcomers, and overall care. Indiana and Wisconsin have repealed their CON laws, and Kentucky is drastically scaling back.

What can YOU do? Ways to Engage

Thoughts Leaders in Healthcare

There are a number of groups and thought leaders that opine in the healthcare space. They provide insightful background information, up to date information at the state and/or federal level, and often suggestions for engagement. In addition, several of these sites provide daily or weekly email updates to which you can subscribe. For additional information on policy engagement, explore the links below:

- Illinois Policy Institute– An independent research and education organization generating public policy solutions aimed at promoting personal freedom and prosperity in Illinois.

- American Action Forum– A center-right policy institute providing actionable research and analysis to solve America’s most pressing policy challenges.

- American Enterprise Institute– Community scholars and supporters committed to expanding liberty, increasing individual opportunity, and strengthening free enterprise.

- CATO– A public policy research organization — a think tank – dedicated to the principles of individual liberty, limited government, free markets and peace.

- The Henry J. Kaiser Family Foundation– A Foundation which states a mission to be a trusted source of information in a healthcare world “dominated by special interests”.

- Heritage Foundation– A conservative research and educational institution—a think tank—whose mission is to formulate and promote conservative public policies based on the principles of free enterprise, limited government, individual freedom, traditional American values, and a strong national defense.

- Opportunity Lives– Opportunity Lives is a news platform dedicated to discovering and highlighting real-life success stories and solutions across America. Values include supporting a free society and limited government.

- State Policy Network– A collection of 65 market-oriented, state-focused think tanks representing all 50 states

Contact Your Representatives

Representatives must hear from their constituents in order to make thoughtful, informed choices. If you have an opinion, make it known. Write letters, vote, boycott, form petitions, fundraise, contact your local newspaper, and/or run for office. Recognize that this is your community. Research your local town hall and find out its schedule. Attend meetings and voice your opinions and concerns.

At the Illinois General Assembly’s next session, a number of healthcare bills are sure to be considered. Introduced bills will be available on the General Assembly’s website in January. Consider contacting your representatives and letting them know what you think. A list of relevant contacts are found below. Please note that legislation is often referred to more than one committee due to committee jurisdictions which vary by state, house, and committee.

Senator William R. Haine (D) Chairperson of the Senate Insurance Committee The committee considers insurance mandates and other insurance related policy matters. Senator 56th District 311C Capitol Building Springfield, IL 62706 (217) 782-5247

Senator Daniel Biss (D) Chairperson of the Senate Human Services Committee Senator 9th District M121 Capitol Building Springfield, IL 62706 (217) 782 2119

Senator John G. Mulroe (D) Chairperson of the Senate Committee of Public Health. This committee considers public health matters. Senator 10th District 127 Capitol Building Springfield, IL 62706 (217) 782-1035

Senator Heather A. Steans (D) Chairperson of the Senate Appropriations Committee 1 Committee that makes spending and budgeting decisions Senator 7th District 122 Capitol Building Springfield, IL 62706 (217) 782- 8492 (217) 558- 6006 FAX

Senator Dan Kotowski (D) Chairperson of the Senate Appropriations Committee II Committee that makes spending and budgeting decisions Senator 28th District 124 Capitol Building Springfield, IL 62706 (217) 782- 3875 (217) 558-6006 FAX

Senator Toi W. Hutchinson (D) Chairperson of the Senate Revenue Committee. This committee evaluates taxing and other revenue decisions. Senator 40th District 121C Capitol Building Springfield, IL 62706 (217) 782 7419 (217) 782 5340 Fax

Representative William Davis (D) Chairperson of the House Health & Healthcare Disparities Committee. 254-W Stratton Office Building Springfield, IL 62706 (217) 782-8197

Representative Mary E. Flowers (D) Chairperson of the House Health Care Availability and Accessibility Committee 251-E Stratton Office Building Springfield, IL 62706 (217) 782-4207 maryeflowers@ilga.gov

Representative Greg Harris (D) Chairperson of the House Appropriations Human Services Committee. This committee considers spending and budgeting decisions. 253-S Stratton Office Building Springfield, IL 62706 (217) 782 3835 (217) 557 6470 FAX

Representative John E. Bradley (D) Chairperson of the House Revenue and Finance Committee. This committee evaluates taxation and other revenue related decisions. 259-S Stratton Office Building Springfield, IL 62706 (217) 782-1051 (217) 782- 0882 FAX

A variety of other state stakeholders are listed below. Take some time to review the positions and history of each entity and what they wish to see accomplished in Illinois.

- The Illinois Department of Public Health, which oversees the health of all of the state’s citizens.

- The Illinois Health Facilities and Services Review Board, which oversees the process of administering Certificates of Need.

- The Illinois Department of Healthcare and Family Services, which manages the responsibility of providing eligible adults and children with Medicaid and enforcing Child Support Services.

- The Illinois State Medical Society, which represents and supports all of the state’s physicians.

Key Questions

ACA

ACA’s objectives were to expand coverage and reduce costs. As noted by experts, the reduction in costs have been difficult to identify. Was the expansion of coverage needed and justified?

Many policy makers believe that states should have the flexibility to design healthcare programs for their unique populations. How do you feel about states having increased flexibility for the design of their healthcare programs?

Illinois chose a partnership exchange to follow ACA requirement that states offer marketplaces for individuals to obtain coverage. Do you think it was wise for the state to retain some ownership of their marketplace? Many states, like Indiana, required the federal government to run the state exchange entirely.

Was the Supreme Court well-reasoned in their ruling in King v. Burwell and was their holding supported by constitutional principles and precedent?

The employer mandate creates a definition for full time employee at 30 hours a week. There is some evidence that a reduction in employee hours has occurred by some employers to avoid having to offer “qualified and affordable” health insurance to workers. If an employer, how have you addressed this challenge in your business?

There are various proposals introduced by Republican elected officials and think tanks to repeal and replace the ACA. Are you supportive of any of the specific concepts that have been introduced? What will it take to legislate- and sign into law- these sweeping changes to our healthcare system?

- Should state employees be allowed to receive level funding or similar coverage for their health insurance plans even with the Cadillac Tax and pass off the extra expenses to taxpayers?

- Would reducing the state employee health insurance plans to avoid the Cadillac Tax only serve as a temporary fix to larger problems within the ACA?

- How can employers respond to the employer mandate of the ACA in order to avoid a drastic reduction in employment?

Medicaid

Medicaid enrollment surged 68 percent over the past 10 years. How do we reduce the number of people on Medicaid? How can the Medicaid discussion shift from increased costs and enrollment to employment?

- Are there unnecessary barriers to self-sufficiency under the current Medicaid system?

- Should the state roll back its Medicaid expansion under the ACA?

- Should the state re-hire a private vendor to completely handle eligibility fraud?

- Should Illinois Medicaid be transferred to a “sliding-scale” system, targeting resources to those who need it the most?

State Employee Health Insurance Plans

- Should state employee health insurance plans be scaled back?

- Should state employees have to pay a larger percentage of their healthcare costs?

Certificate of Need

- Are Certificates of Need still necessary?

- If so, should the system be revised in order to cut back on power control?