Tax Reform – Understanding the Debate

By The Policy Circle Team

A Cheat-Sheet to Understanding the Tax Reform Debate

Taken altogether [the House Republican tax plan] amounts to just over $300 billion in tax reductions for individuals, a $172 billion estate tax cut and about $1 trillion for businesses, a mix Republicans say will improve an archaic business tax code and put money in the pockets of households. (WSJ)

Tax reform has been a stated priority. Reducing taxes and simplifying the tax filing process keeps money in the hands of those who earned it, increases transparency into who pays what to the government and why, and forces government to do more with less. Article I, Section 8, of the U.S. Constitution outlines that “Congress shall have Power to lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States.”

Following are some recent developments in the process for tax reform and what it could mean for taxpayers.

TAX PROCESS

Why was the Budget Resolution so Important?

It’s part of the process. The tax debate started with passing a budget bill, which is a non-binding resolution that – when passed by both the House and Senate – opens the door for a bill to be considered under reconciliation rules. Bill passage under reconciliation only requires support from a majority (51) in the Senate, making it much easier to pass than the usual 60 votes it takes to pass legislation in the Senate. Taking this approach is necessary since Democrats and Republicans are not in a place to compromise on major legislation.

Under reconciliation guidelines, the tax bill must conform to the Senate’s Byrd Rule, which among other things requires that the bill “cannot increase the long-term deficit beyond a predetermined level.” The House and Senate passed a budget resolution in October 2017 that set that level at $1.5 trillion over the first decade. Anything above that number has to be paid for elsewhere in the tax plan. The Byrd rule also requires that the tax bill is deficit neutral in the ‘out years,’ meaning the tax bill cannot cause the deficit to increase outside of the 10-year budget window.

The Budget Resolution was Approved – Now What?

Per the U.S. Constitution, revenue raising bills originate in the House of Representatives. The House Ways and Means Committee took the lead in drafting the tax reform legislation, building on input gathered from committee hearings and meetings. A ‘mark-up’ in the Ways and Means Committee gives the deep bench of tax experts who serve on the Committee an opportunity to publicly debate and amend the bill. Once the bill is voted out of Committee, it moves to the House floor – where it will be debated, amended, and finally voted upon by all 435 members of the House of Representatives.

The Senate is introducing its own tax reform legislation, with the Senate Finance Committee taking the lead. The Senate is also tracking the House process, and compromises between the two chambers have already taken place. In order to meet the Byrd Rule, requiring deficit neutrality in the out years, it is likely that the Senate will have to make changes to the House proposal.

Republicans can only lose 2 votes in the Senate and 22 votes in the House and still pass the bill on a party-line vote. Both the House and the Senate have to approve an identical bill before it can be sent to the President to be signed into law.

TAX BASICS

How Does the Government Collect Income Taxes?

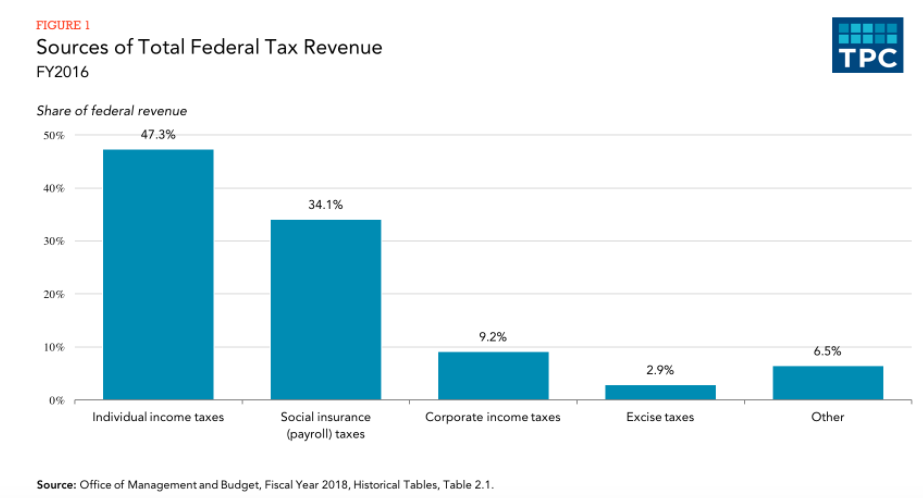

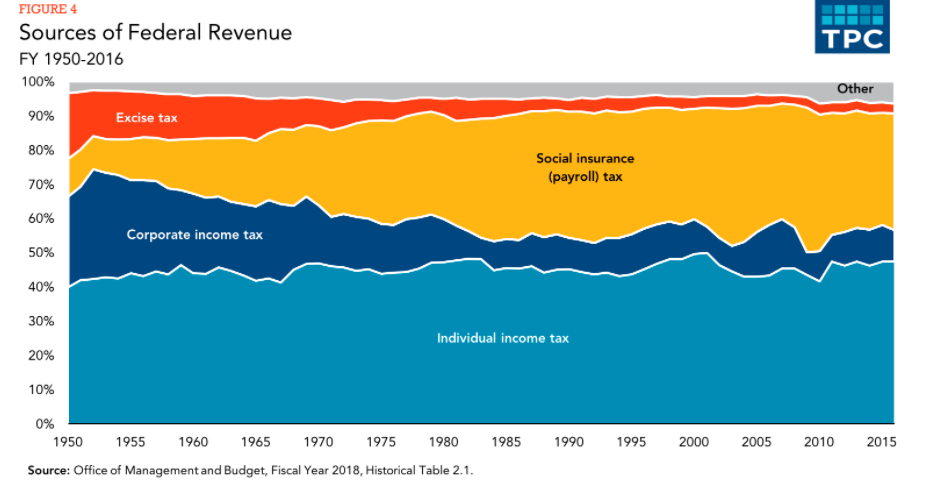

The government receives most of its revenue for its budget through income taxes, which it takes throughout the year by withholdings from your paychecks, or quarterly taxes if you are self-employed. (tax.findlaw.com)

(Source: Tax Policy Center)

What is Taxable Income?

Two types of income are subject to taxation: earned income and unearned income.

Earned income includes:

- Salary

- Wages

- Tips

- Commissions

- Bonuses

- Unemployment benefits

- Sick pay

- Some noncash fringe benefits

Taxable unearned income includes:

- Interest

- Dividends

- Profit from the sale of assets

- Business and farm income

- Rents

- Royalties

- Gambling winnings

- Alimony

One way for individuals and couples to reduce taxable income is by contributing to a retirement account like a 401(k) or an IRA. (tax.findlaw.com)

The current proposal does not change 401(k) contribution limits:

The House plan scrapped the idea of raising revenue to pay for tax cuts by drastically reducing (from $18,000 to $2,400 per individual per year) the pre-tax amount that individuals and married couples could contribute to workplace saving plans…” (Wash Post), “Making 401(k) contributions taxable would [have increased] tax revenue by about $584 billion through 2020, according to calculations by the nonpartisan Joint Committee on Taxation.” (Investopedia)

Indexing to Inflation?

The costs of goods and services generally increase year over year so tax credits, for example, that aren’t indexed to inflation are worth a little bit less to taxpayers every year.

Personal Exemption?

The House proposal eliminates the personal exemption, “which subtracts more than $4,000 from taxable income for filers, their spouses and dependents.” (WSJ) The idea behind the personal exemption for taxpayers and dependents was to set a basic level of income that wasn’t taxed, to help ensure that the poorest households are not subject to the income tax. “In 1913, the personal exemption was set at $3,000 (worth more than $70,000 in today’s dollars), so that very few persons were expected to pay tax. In 2017, the personal exemption is $4,050… it phases out completely at $384,000 for single filers and $436,300 for married filing jointly taxpayers.” (Tax Policy Center) In place of the personal exemption, the House proposal vastly increases the standard deduction.

What Is a Tax Deduction?

Deductions are subtracted from your income before you determine the amount of tax you owe. (www.irs.gov)

Standard Deduction is set in the tax code and varies by your filing status. The House proposal increases the standard deduction, in some part as a way to ensure taxes don’t increase as a result of fewer tax brackets, eliminating the personal exemption, and eliminating many credits and individual deductions. Currently, the standard deduction is $6,350 for single taxpayers ($12,700 for married couples). Under the House proposal it would increase to $12,000 ($24,000 for married couples).

Itemized Deductions currently include mortgage interest, state and local taxes, charitable contributions, and medical expenses. (tax.findlaw.com) Based on the current tax reform proposal – only mortgage interest (set at a lower cap), charitable contributions, and property tax up to $10,000 will be deductible – in addition to an increased standard deduction.

Mortgage Interest Deduction – The House proposal caps the home mortgage interest deduction at $500,000 of principal for any new primary home purchase – this is down from the previous cap of $1 million that can be deducted today. In other words, “the mortgage-interest deduction would no longer apply to interest on debt above $500,000, home-equity loans, or second homes.” (WSJ) Additionally, the cap isn’t indexed to inflation. Generally speaking, this hits homeowners in (northern) areas where real-estate prices are high, while also hitting (southern) states where vacation homes are common because the deduction would no longer apply to vacation homes.

State and Local Income & Property Tax Deduction – currently you can deduct the income and property taxes you pay at the state and local level from your federal income taxes. The proposal would eliminate the ability to deduct state and local income tax, and would cap the property tax deduction at $10,000. These Representatives from high tax states have come out against the current proposal: Leonard Lance (R-NJ), Peter King (R-NY), Lee Zeldin (R-NY), Frank LoBiondo (R-NJ).

Some say this deduction is currently an unfair handout to high-tax states, while others counter that eliminating the deduction amounts to double taxation. Economists estimate that ending the deduction would bring in an extra $1.3 trillion dollars of federal tax revenue over the next 10 years. And supporting analysts point out that states with a lower tax burden are able to achieve higher rates of growth in almost every economic category. (How Money Walks, forbes, alec)

What Is a Tax Credit?

Once a person has determined how much tax they owe, they can subtract tax credits before determining the final amount of tax due. There are two types of tax credits:

- A nonrefundable tax credit means you get a refund only up to the amount you owe.

- A refundable tax credit means you get a refund, even if it’s more than what you owe. (www.irs.gov)

Child Tax Credit – The current tax reform proposal would expand the child tax credit from $1,000 to $1,600 per child under age 17, and would start to phase out for married filers making $230,000. The first $1,000 would be refundable – meaning if the credit exceeds the taxes owed, you can receive it as a refund. Senators Marco Rubio and Mike Lee are lobbying for a larger child tax credit. The proposal also proposes the creation of a new $300 nonrefundable “family” credit allowed to each taxpayer and non-child dependent. The $300 credit has a phaseout of $230,000 for married filers and 115,000 for individual filers, and expires after 2022.

Adoption Tax Credit – Pro-life groups and social conservative leaders are fighting to save the credit from elimination. Penny Nance, Concerned Women for America, expressed this sentiment: “the majority of families who sacrificially walk out their faith by caring for ‘the least of these’ through adoption depend on the ability to afford the costs…I am almost speechless at the lapse of judgement but we will work to clean up the mistake.” “Chairman Kevin Brady, who is an adoptive father, explains: ‘We are working to give families not only help when they’re adopting but every year when that child is growing up, by making sure they have more in their paychecks to raise kids.’” (Axios, CNN)

Medical Expenses Tax Credit – A number of Republicans believe it’s political malpractice to eliminate a longstanding tax break for people who have very high medical costs. (Axios)

OTHER MAJOR PERSONAL TAX PROVISIONS

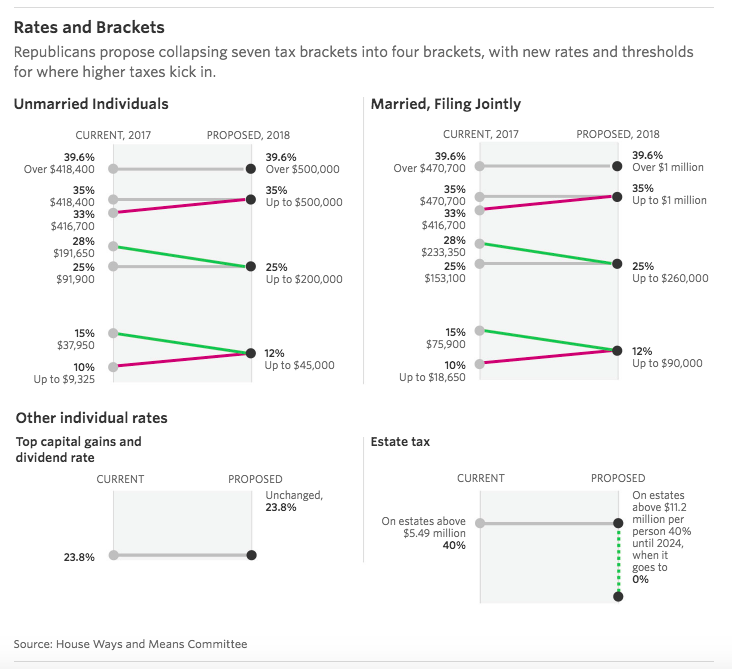

Simplification – A large part of simplification is collapsing tax brackets. By almost doubling the standard deduction, the tax proposal eliminates the need for many of the smaller credits and deductions, and importantly, ensures taxes do not increase for the current 10% tax bracket that is rolled into a new 12% tax bracket. Simplification addresses the calls for fairness and transparency in the tax code.

Source: WSJ

Estate Tax – Currently, Americans can pass along homes, land, stocks or other assets worth up to $5.49 million without paying any estate or gift tax. Estates worth more than that are subject to a 40 percent tax. The House GOP bill would double the threshold to $11.2 million in 2018 and then do away with the tax entirely in 2024. (Washington Post) “Economists tend to see the estate tax as one of the most economically harmful taxes per dollar of revenue raised.” (The Tax Foundation)

One analysis claims, “Eliminating the federal estate tax (and related gift taxes) has been estimated to boost U.S. economic growth by more than $46 billion over the next 10 years and generate an average of 18,000 private-sector jobs annually.” (Heritage, 2014) This growth is projected despite the $172 billion reduction in revenue from eliminating the estate tax. The current House proposal would not repeal the related gift tax, but would lower the top tax rate to 35 percent from 40 percent and the lifetime exemption would double to almost $11 million. (Investment News)

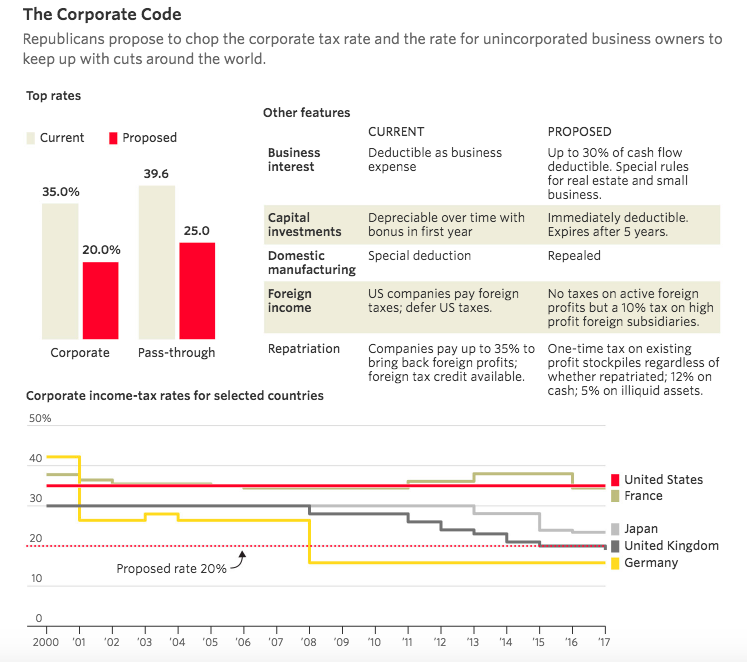

THE BUSINESS SIDE

Source: WSJ

Foreign Income: Converting to a worldwide tax system – The goal of this shift is to increase the United States’ competitiveness in attracting multinational corporations and reducing the incentive to keep corporate income outside of the U.S., or “offshore,” so that these dollars can return home and be put to work in the U.S. economy.

“In much of the industrialized world, domestic corporations are taxed on their domestic income alone (a so-called territorial tax system). In the U.S., by contrast, companies are taxed on their worldwide income, with credits for taxes paid to other countries (a so-called worldwide tax system). If tax liability is lower in another country in which a controlled foreign corporation operates, the residual amount is paid to the United States. This increases overall [tax] liability and makes the U.S. comparatively unattractive as a home for multinational corporations. ” (The Tax Foundation)

Business Interest – The proposal limits a company’s ability to deduct interest to 30% of that company’s earnings (before interest, tax depreciation and amortization) with a five-year carry-forward basis. Businesses with less than $25 million in gross receipts would be exempt from the limitation. (The Tax Foundation)

“Interest involves money changing hands, but it creates no net increase in national income. Some tax systems attempt to track interest payments as they change hands and adjust tax burdens based on those interest payments. Other tax systems take a shortcut and acknowledge that on net, every interest payment has matching interest received elsewhere, and therefore, one can simplify the code by ignoring interest entirely.” The U.S. tax code currently allows deductions on interest paid while taxing interest received, but in practice, a substantial portion of interest is untaxed. This results in a tax advantage for debt financing over equity financing. (The Tax Foundation)

Ongoing negotiations acknowledge that reducing the deductibility of interest works for a lot of businesses – but high-inventory, low-margin businesses, such as car and tractor dealers, are lobbying for a carveout. Speaker Paul Ryan originally proposed “eliminating interest deductions entirely for the purpose of allowing full and immediate expensing,” but push back from debt-reliant companies led Senate Republican opposition to kill Ryan’s proposal. (Bloomberg)

Pass through provisions – ‘pass-through’ business income is “income from entities like S-corporations and limited-liability companies that do not pay their own taxes, but pass their income through to their human owners, who then pay tax on that income on their individual income tax returns.” (Business Insider) The proposal sets a preferential tax rate at 25% for these businesses, as long as they can prove that it is business income, and not simply labor income.

“In general, owners who actively participate in their businesses would face a 70/30 rule: 70% of their income from the businesses would have to be treated like salary (and taxed at rates up to 39.6%) and only 30% of their income would enjoy the 25% preferential rate.” (Business Insider) But professional services firms – for example, if I set up Kristin Jackson LLC and sell my services to my employer instead of taking a salary – would have to treat 100% of the owner’s income as salary, taxable at up to 39.6%. The National Federation of Independent Business (NFIB) isn’t supporting this first House draft, saying the provisions wouldn’t provide enough help to small businesses.

20% excise tax on payments – including royalty payments – that U.S. companies make to their offshore affiliates. This provision is aimed at preventing companies from shifting their U.S. profits to offshore units in countries with lower tax rates, and it “caught everyone by surprise.” According to the WSJ, the proposal would raise $154.5 billion over a decade. The tax is troubling for multinational corporations, who say it would disrupt global supply chains, and it is likely that well-funded lobby groups will mobilize against it. Americans for Prosperity has come out in strong opposition to this measure, complaining that it could increase consumer prices, and calling it a “backdoor BAT” – relating to prior fears that the border adjustment tax would force consumers to pay higher prices for common goods. In the Committee markup, “Republicans proposed changes that appear to be less onerous on multinational companies than the original version was.” (WSJ)

Carried Interest: This refers to “the portion of an investment fund’s profit — usually a 20 percent share — that is paid to investment managers.” (Bloomberg) “Carry is not automatic; it is only created when the fund generates profits that exceed a specified return level known as the hurdle rate. If the hurdle rate of return is not achieved, the general partner does not receive carry, although the limited partners continue to receive their proportionate share. Carry can also be clawed-back if the fund underperforms over time.” (Investopedia)

Currently, “tax authorities treat that income as capital gains, making it eligible for a tax rate as low as 23.8 percent — on gains from assets held for a year or more.” This is a significant break from the top tax rate for ordinary income, which is 39.6 percent. The proposed change would double the length of time an asset would have to be held to qualify for the lower rate. According to Brady, “We will put in the two-year holding period on carried interest to make sure it’s really focused on those long-term, traditional real estate partnerships.” (Bloomberg)

Repatriation of profits means bringing them back to one’s own country. The House proposal includes a one time tax on all foreign profits, whether or not that company decides to repatriate their cash and assets back to the U.S. Cash would be taxed at 12% and illiquid assets at 5%.

Expensing is a bring spot for businesses. The House proposal would allow immediate and full expensing for capital investments. Due to the cost of this provision, it is set to expire in five years.

ONGOING DISCUSSIONS

- Ongoing discussions of a homeowner tax credit would combine benefits for mortgage payments and property taxes after capping the mortgage interest deduction. (POLITICO)

- Obamacare’s individual mandate: tax writers are looking at the budgetary impact of adding language repealing Obamacare’s individual mandate. Central in the discussion is how much money the mandate repeal would generate, and if the addition would derail the bill’s momentum.

- Private universities with assets exceeding $100,000 a student would pay a new 1.4% excise tax on their net investment income. (WSJ) This has been slightly amended since first introduced, “Under the change, institutions with endowment assets of at least $250,000 per student would face the tax — up from an original $100,000 level.” (Bloomberg)

- Navigating Senate Deficit Hawks and Moderate Senator Collins: Only Senator Corker (R-TN) has “flatly declared that he would reject a tax bill if it added even a cent to the deficit… John McCain voted against the Bush tax cuts in 2001 and 2003 in part because of their impact on the deficit.” (Politico). Senator Senator Collins (R-ME) “sees no need to dump the real estate tax.” She has also expressed concern about eliminating the state and local tax deduction – calling it double taxation.

Politico’s take on tax reform: VIDEO