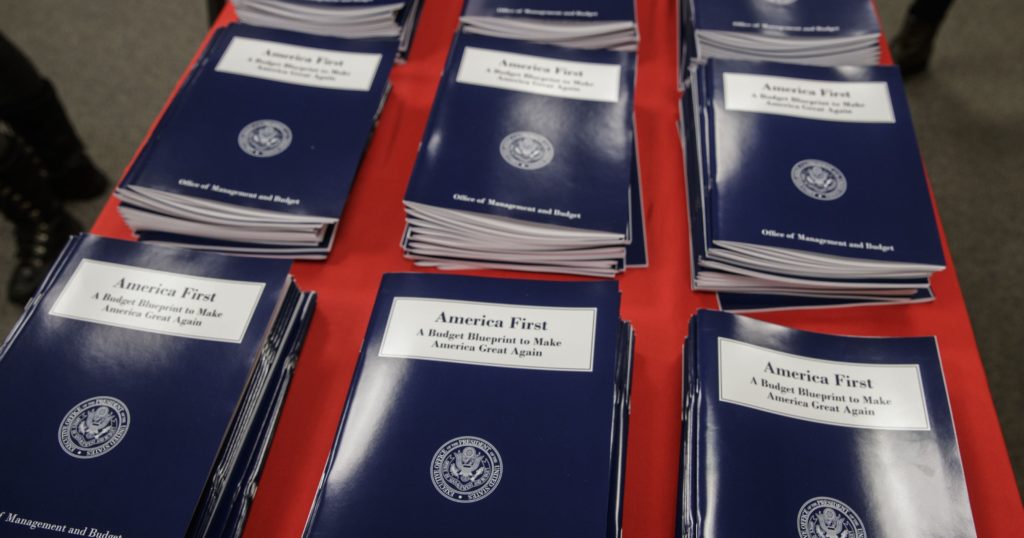

On March 16th, the Administration released its “skinny budget,” a blueprint of “how much money the administration wants Congress to send to each agency, along with what they plan to do with it.” Many departments and agencies saw their budgets substantially cut, others were increased. Some call for entitlement reform, noting this budget “avoided the tough decisions.” Big winners include school choice, along with national defense and Veterans Affairs. Many programs are entirely defunded. You can find more details about the budget here.

Over the coming months you will see much analysis of the numbers and implications for programming. Before you try to digest the national budget, it might be a good time to deepen your budgeting skills and understanding of the many ways budget numbers can be calculated.

What’s your literacy score?

In a recent survey 45% of U.S. adults gave their personal finance knowledge a grade of “C” or worse. Our teens don’t fare much better: U.S. teens rank 8 points below global average in their skills and knowledge of financial issues. How can we expect citizens to study and take a position on our national budget without the understanding and the tools to do so?

Fortunately, a number of organizations are making strides in trying to remedy these high levels of illiteracy in personal finance. “Rock The Street, Wall Street” is pioneering a new model for financial literacy education, to address “financial naivete among women,” which “cuts across all socioeconomic classes.” They cite the shocking statistic that “two out of three women state they know little to nothing about finance.” The program targets high school girls, sparking their interest and engagement with STEM (Science, Technology, Engineering and Math) before college, and inspiring them to pursue professions in finance. Pairing a financial literacy curriculum with opportunities to engage with real-life role models, the group provides girls with “instruction, exposure and formal mentorship with female bankers, auditors, analysts, entrepreneurs, wealth managers, traders, and accountants.” Since 2013, the organization has “served over 600 girls in 5 cities, including Chicago, Dallas/Ft. Worth, Memphis, Nashville, and New York City.”

To sharpen your own personal finance skills (or to help your kids improve their grasp of finance), explore this list of free financial literacy tools from NerdWallet, an American personal finance website geared toward millennials, which educates consumers in making financial decisions.

To target college level students, brokerage firm TD Ameritrade launched TD Ameritrade University to combat low financial literacy and the fact that “schools are not equipping youngsters with the financial smarts to handle core life tasks like budgeting and retirement saving.” The learning site is designed for students to “craft simulated investment portfolios and for finance professors to arrange investing competitions for their classes.”

Stay tuned for a follow-up post on balancing the federal budget and the Congressional budget process!

It’s a movement!

Recommend a Circle Leader. Especially in Nebraska, Wisconsin, Minnesota and Missouri where circles are sprouting.

Start a Circle in your neighborhood. Add value in your community by giving women the facts and the space to strengthen their understanding of the issues.

Invest in The Policy Circle. Together let’s build a network of women who want to assume their civic duties and understand the impact of policy in their lives.

The Policy Circle is a 501(c)3 that provides a fact-based, nonpartisan framework that inspires women living in the same community to connect, learn about and discuss public policies that impact their lives. Women across the nation are taking a leadership role in public policy dialogue on what human creativity can accomplish in a free market economy.