The Numbers Behind the Shutdown

By The Policy Circle Team

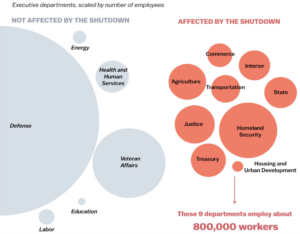

The shutdown continues to dominate the newscycle. Since our original post on the shutdown , the debate continues over a path forward. In the interim, 800,000 federal workers’ and countless private sector contractors’ (from janitorial staff to technology consultants) livelihoods remain at stake since 80% of American workers live paycheck to paycheck (CBS).

Who are the 800,000?

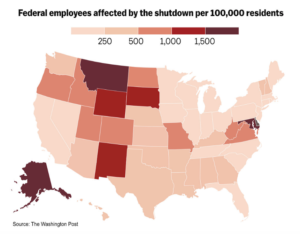

800,000 people is a staggering number; in fact, it is more than the population of Washington, DC. You may be wondering if furloughed employees are just an issue for the nation’s capital? Vox.com distilled the shutdown into 8 graphs to explore the impact by state and department including the two below. For example, The Department of the Interior has a 76% furlough rate meaning states with national parks like Montana, South Dakota, Arizona, and Wyoming have been significantly impacted. To read the full article and dive deeper into the numbers, click here.

What is our total federal budget?

The administration has released spending figures based on projected revenue from taxes, tariffs, and contributions.

“In February 2018, President Trump released his budget proposal for fiscal year 2019. Under his proposal, the federal budget would be $4.407 trillion. The U.S. government estimates it will receive $3.422 trillion in revenue, creating a $985 billion deficit for October 1, 2018, through September 30, 2019. In Trump’s budget, spending was in three categories: Mandatory, which is at $2.739 trillion; Discretionary at $1.305 trillion; and Interest on the National Debt, $363 billion.” (The Balance)

How did the Office of Management & Budget (OMB) get to these numbers?

The National Priorities project lays out the budget by answering 3 simple questions. Take a look!

What does The American Taxpayer get for $5.7 billion towards border security?

The latest fact sheet from the White House outlines what is included in the border security proposal and includes funding for technology, canines, personnel and humanitarian assistance.

Hopefully, this process has ignited interest among taxpayers to engage with their representatives about the budget and what programs are most important to them.

Take a poll of your circle: How should the budget be allocated? How can tax revenue be used to make a difference for the most American people? The Taxation brief is a great place to kickstart your conversation.

| It’s a movement!

Recommend a Circle Leader. Especially in Georgia, California, Wisconsin, and Michigan, Kansas and Arizona where circles are sprouting. Start a Circle in your community. Your community may be your profession or your neighborhood, or both. The Policy Circle is a simple way to practice the language of leaders with the facts and the space to be at ease with weighing in on the impact of policy. Invest in The Policy Circle. Together let’s build a network of women who want to be part of the dialogue on the impact of policy in their lives. The Policy Circle is a 501(c)3 that provides a fact-based, nonpartisan framework built to inspire women living in the same community to connect, learn about and discuss economic policies that impact their lives. Women across the nation are taking a leadership role in the public policy dialogue on what human creativity can accomplish in an open economy. |