The House and Senate have formed a consensus tax bill. The goal is to pass the bill in the House this week, and then in the Senate the following day, before sending it to the President. The target is to have it signed into law by December 20th.

One side of the political aisle lauds the tax bill as the most important tax reform in 31 years. The other side calls it Armageddon.

Pro vs Anti- Tax Bill

The “pro-tax bill” side says it will help the middle class by simplifying the tax code, reducing taxes for the majority of Americans and making it easier for businesses to be successful. This last point is important because it promises to finally drive up Americans’ wages that have been generally stagnant for decades. When thriving businesses compete for employees, wages go up. (Harvard Business Review)

The “anti-tax bill” side says the bill is designed to only benefit big business and the wealthy, while increasing income disparities between the rich and the poor, and that it could actually harm Americans.

Context

The context for these vastly different analyses is that one perspective believes that the U.S. should consist of a larger federal government providing for its people, particularly the poorest among us, and that we should tax the American people, particularly the wealthiest among us, to pay for it.

That perspective will most always clash with a view that replacing a large government with empowered people, lower taxes, and reduced red tape provides more room for people to innovate and small businesses to grow and allows any American among us to work hard and grab their piece of the American dream.

The belief that a rising tide raises all boats, as long as personal responsibility and hard work remain central tenants of our culture, is no longer held as a foregone conclusion for many in today’s society.

Keeping those competing forces in mind, below are two major debate topics you might come across in friendly conversation.

Question: IS THE TAX BILL ONLY HELPING THE RICH?

Four major provisions in the bill that have been said to benefit the rich are 1) the lower corporate rate, 2) the deduction for ‘pass-through’ entities, 3) the way in which the individual tax cuts are applied, and 4) the new estate tax threshold.

1. Corporate Tax Rate

One perspective says cutting the corporate tax from 35 to 20 disproportionately benefits the wealthy. For example, the Washington Post says: “Wealthier Americans would […] benefit from a permanent cut in the corporate tax rate, which will likely boost the incomes of people who own companies or investments.”

What that quote doesn’t take into consideration is that the salaries and wages of American workers will benefit from adding the size of Italy’s economy to ours.

The nonpartisan Joint Tax Committee reports that tax cuts will add about 0.8% to gross domestic product over the next decade. Other groups project much higher growth. As economist James Carter points out, with U.S. economic output totaling nearly $237 trillion over the decade as projected by the Congressional Budget Office – a 0.8% increase boosts that number by $1.9 trillion. Which is the equivalent of adding Italy’s economy to our own.

“When the economy grows, that means that wages, salaries, and income from savings grow. That additional output — in this case, the size of Italy — is additional income for workers and savers… Tax reform should be about raising the people’s income, not the government’s.”

Another interesting component of the corporate tax is the issue of double taxation. Corporate income that is distributed to shareholders as dividends is taxed as the corporate level and the individual income tax level. (Tax Foundation) While working to make the U.S. more globally competitive, the reduced corporate tax rate only reduces the burden on one side of that double tax.

2. Pass-Through Tax Rate

One perspective says reducing taxes on “pass-through” entities only helps the rich. Pass-through entities are large and small businesses, and the assertion is that wealthy Americans are utilizing the pass-through structure to lighten their tax burdens. (Vox: here and here).

The above points don’t take into account the value of business creation and wages that come from the 94 percent of all businesses that are categorized as “pass-throughs”.

Pass-throughs don’t have to pay business taxes at the entity level; instead, all of their income passes through to their owners’ individual tax returns. The compromise bill allows pass-through entities to deduct 20% of their profits from their taxes.

These small, medium and large businesses, including start-ups, that are structured as pass-through entities drive innovation and entrepreneurship in our nation. They employ many Americans whose wages and salaries would benefit from pro-business tax policy.

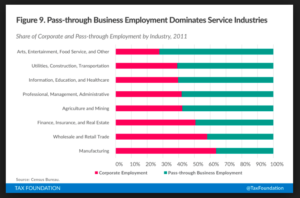

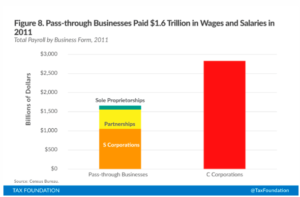

“Pass-through businesses now account for 94 percent of all businesses, earn more than 64 percent of total business net income, and employ more than half of the private sector workforce in the United States. In addition, they pay more than $1.6 trillion in wages and salaries and operate in every U.S. industry.” (Tax Foundation)

3. Individual Tax Rate

One perspective says the individual tax reforms also benefit the wealthy more than others. For example, this Vox article is concerned that: “In 2019, a person in the bottom 10 percent gets a $50 tax cut and a person in the top 1 percent gets a $34,000 tax cut.”

This analysis doesn’t consider the larger percentage of individuals in lower tax brackets who will now pay no tax at all and the “top 1 percent of earners in our nation pay a greater share in individual income taxes (39.5 percent) than the bottom 90 percent combined (29.1 percent).” (Tax Foundation)

According to Senator Portman, “Three million people, all told, are going to fall off the tax roles altogether.” He is referring to people who now have an income tax liability but won’t after the bill is signed into law. Additionally, “More than 60 percent of households would see a tax cut of at least $100 in 2019…” (The Hill)

And according to Tax Foundation, in 2014 “the top 50 percent of all taxpayers paid 97.3 percent of all individual income taxes while the bottom 50 percent paid the remaining 2.7 percent.”

4. Estate Tax Threshold

A common argument is that the estate tax reform clearly only benefits the wealthy. The compromise bill determines that no estate tax is applied for individual estates under about $11 million, instead of the previous $5.6 million. The estate tax is a 40 percent tax on property (cash, real estate, stock, or other assets) transferred from a deceased person to his or her heirs.

The other perspective of this debate points to this analysis: “Last year the Tax Foundation found that the US could create over 150,000 jobs by repealing the estate tax. A 2012 study by the House Joint Economic Committee found that the death tax has destroyed over $1.1 trillion of capital in the US economy – loss of small business capital means fewer jobs and lower wages.” (Family Business Coalition)

Question: WILL THE TAX BILL WILL HURT AMERICANS’ HEALTH?

1. Alcohol Tax Reduction

According to Brookings Institution analysis: “If enacted, the Senate alcohol-tax cuts would cause 1,550 additional alcohol-related deaths each year… Why do higher alcohol taxes save lives? Because when alcohol is more expensive, people drink less of it.” (Washington Post)

2. Elimination of Health Care Mandate

According to economist Larry Summers, 10,000 people will die annually from the GOP tax bill: “When people lose health insurance, they’re less likely to get preventive care, they’re more likely to defer health care they need, and ultimately they’re more likely to die.” Summers said on CNBC’s “Squawk Box.” (The Hill) Summers is asserting that without the mandate, less people will buy insurance, and with less people in the marketplace, insurance will become unaffordable for more people.

What isn’t taken into consideration in that commentary is that the tax bill does not take health care away from any American – it simply removes the fee the government charges you if you don’t buy insurance. The approach outlined above also discounts the need for innovative solutions, competition in the healthcare market, and the role of personal responsibility.

In conclusion

Tax policy is a complex topic with many facets. As you dig in and grasp the various perspectives, you will be better equipped to speak some common sense into the tax reform conversation!

Here is an additional resource on the compromise tax plan: Republicans have a final deal on their tax bill — here’s what’s in it, Business Insider. And the final bill text here.

For more general analysis on how to follow the tax debate, check out the How to Follow the Tax Reform Effort column and the slightly deeper dive into Tax Reform – Understanding the Debate.

What Still Matters is provided by Kristin Jackson, who serves as policy editor for The Policy Circle. Kristin is a middle-of-America native with a decade of experience working on policy in our nation’s capital.

The Policy Circle is a 501(c)3 that provides a fact-based, nonpartisan framework that inspires women living in the same community to connect, learn about and discuss public policies that impact their lives. Women across the nation are taking a leadership role in public policy dialogue on what human creativity can accomplish in a free market economy.