Wisconsin’s economy is growing steadily, with a 3.6% growth in gross state product (GSP) in the third quarter of 2016. Wisconsin’s unemployment rate of 4.0% - 15th lowest among the states - is below the national average of 4.8%. The state’s economic outlook has seen a considerable uptick since Governor Scott Walker and a Republican Legislature have made tax reform a priority. Since 2010, Walker and the Legislature have cut taxes by $4.76 billion. Alongside considerable tax relief, the state’s economy has also benefited from the passage of Act 10, the Right to Work law, and lower debt levels, among many other reforms.

Key Facts

- As of December 2016, Wisconsin’s unemployment rate was 4.0%. The unemployment rate has steadily dropped over the last several years from a high point of 9.2% unemployment in January 2010, and is the overall lowest unemployment rate since

February of 2000.

February of 2000. - Among the top ten in the nation, Wisconsin’s labor force participation rate of 68.3% is currently the highest it has ever been and is better than the national rate of 62.7%. The labor force participation rate is the percentage of the population that is either employed or is actively looking for work. This metric – and not just the unemployment rate – is crucial for a better understanding of the economy.

- In 2016, Wisconsin’s economic outlook ranked 9th among the states and 2nd in the midwest after Indiana. The index considers metrics such as gross state product, domestic migration, growth in payroll employment, as well as a slew of policy variables such as income and property tax burdens.

- Wisconsin’s biggest industries are manufacturing, agriculture, health care, information technology and life sciences. Economic growth is particularly important in these industries since our overall economy relies upon them so heavily.

- Gov. Walker’s approach to economic growth has emphasized substantial tax relief, reducing the size of government, and focusing on certain industries to grow the economy. In 2011, Walker established the Wisconsin Economic Development Corporation (WEDC), to encourage business investment in the state’s economy.

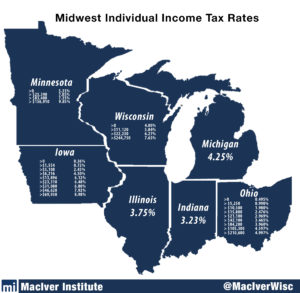

- Wisconsin’s top income tax rate of 7.65% is the 9th highest top rate among the 43 states with an income tax. The bottom rate of 4% is the 4th highest among the 33 states with a progressive income tax.

- According to December 2016 Census Bureau data, Wisconsin’s state and local tax burden ranks 16th among the states at 10.8% of personal income.

- The year prior, Wisconsin’s tax burden ranked the 15th highest in the country. This ranking is expected to continue to drop as tax cuts are fully phased in.

- The nonpartisan Tax Foundation’s ranking of state and local tax burdens put Wisconsin at the fourth highest in the nation, and highest in the Midwest.

- Wisconsin is one of 28 states with a Right-to-Work law. Right-to-Work laws guarantee that no worker is forced to join and pay dues to a union. See the section below for more information on Right-to-Work.

- In 2002 to 2012, states with no income tax had higher levels of personal income growth and gross state product growth than states with high income taxes. Wisconsin is heading in the right direction and improving the state’s competitiveness by reducing its income, corporate, and property tax burdens.

- In 2015, Wisconsin’s poverty rate of 11.9% was 32nd in the country, lower than the U.S. average of 14.4%.

- Annually, Wisconsin loses an estimated $136 million in adjusted gross income to tax migration. In 2015 alone, an estimated net 6,606 people moved from Wisconsin to Florida, which has no income tax.

- Pass-through businesses, which are entities that are taxed under the individual income tax rather than the corporate tax, are now the most common business form in the country. More than half of Wisconsin’s workforce is employed by pass-through businesses, which pay a top marginal income tax rate of over 48% – the 8th highest rate in the country. This gives the individual income tax even greater importance to the livelihoods of Wisconsinites and the success of their businesses.

Addressing Economic Growth in Wisconsin

Economic growth has been a priority for Gov. Walker’s administration. Substantive reforms relating to economic growth include Act 10, tax reform, welfare reform, and the passage of Right-to-Work, among many others.

Right-to-Work laws ensure that individuals must not be coerced into joining and paying dues to a union as a requirement of employment. These states report faster job growth, lower unemployment, and higher wages. One American Enterprise Institute report showed that states with no income tax and Right-to-Work grew the fastest under the Obama administration.

Wisconsin became the country’s 25th Right-to-Work state in March 2015. A Dane County judge struck down the statute in April 2016, temporarily halting the law’s enforcement, but a state court of appeals judge later granted a stay. Today, Right-to-Work is applied as the law of the land while it continues to go through the appeals process in the state of Wisconsin.

The chart on the right shows the change in population from 2010 to 2016 in states with different policies. At 9.1% population growth, states with no income tax grew the most, while states with a right-to-work law grew by 6.2%.

The chart on the right shows the change in population from 2010 to 2016 in states with different policies. At 9.1% population growth, states with no income tax grew the most, while states with a right-to-work law grew by 6.2%.

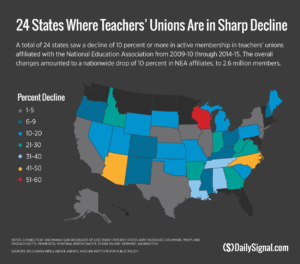

One recent Daily Signal article explored the effect of Right-to-Work laws on teachers’ union membership across the country. The Wisconsin Education Association Council has lost about 60 percent of its members since Act 10’s implementation – the largest decline in the country.

Comparing Tax Rates across the Midwest

Thought Leaders and Additional Resources

MacIver Institute Coverage:

- Gov. Walker Announces New Welfare Plan – MacIver Institute, January 2017 – video, news story

- Glidepath to a 3% Flat Income Tax: Comprehensive Tax Reform for a More Competitive Wisconsin – MacIver Institute, January 2017 – report

- Foust’s Right-to-Work Folly – MacIver Institute, April 2016 – opinion story

Other Resources:

- Tax Foundation: State and Local Tax Burden Rankings, FY 2012

- The Tax Foundation is a helpful resource for anyone looking to learn more about economic policy and tax levels, especially among the states. Check out their Tax Freedom Day report, which tracks the day when the nation as a whole has earned enough money to pay its taxes for the year.

- Mercatus Center: The Great Flat Tax Debate

- The Mercatus Center focuses on issues such as fiscal policy, healthcare, regulation, monetary policy, and many others. This link is an hour-long debate featuring Veronique de Rugy, senior research fellow at Mercatus, on the merits of a flat tax. Mercatus creates content in variety of formats, including blog posts, full-length reports, and audio clips.

- Legislative Fiscal Bureau: General Fund Revenue and Expenditure Projections

- Wisconsin’s Legislative Fiscal Bureau (LFB) is a nonpartisan organization that serves the Legislature in providing independent fiscal information. The most recent general fund revenue letter, published January 18, 2017, offers an interesting look into the latest developments in state policy. This memo made headlines in January because it predicted much higher tax collections than anticipated, meaning that the government has more money to spend in the coming biennial budget.