The U.S. welfare system is supposed to serve as a leg up to those in need. But for poor families in Chicago and across the state, Illinois’ welfare system can function more like a boot on the neck than a helping hand.

Facts to Know About the Illinois Economy & Poverty

- Illinois’s population is 12.8 million, the fifth most populous state in the nation and largest in the Midwest.

- Illinois’s share of the national economy fell from 4.91% in 1997 to 4.32% in 2013

- Chief Executive Magazine ranked Illinois 48th among states for business climate

- The current unemployment rate is 5.8%, almost a full point improvement from last year.

- At the end of last year a total of 1,052,548 Illinois households, or 22% of all Illinois households, were on food stamps.

- A 2014 Harvard study ranked the state near the top quartile for illegal corruption and legal corruption.

- Illinois has one of the worst lawsuit climates in the nation, ranking 46th out of all 50 states. Illinois has two of the top five counties in America named as “judicial hellholes” by the American Tort Reform Association based on lawsuits filed and size of awards. Incarceration perpetuates the cycle of poverty.

How We Compare

Job Growth

According to a recent Gallup poll, having a good job is the number one social value in the world, more important than having a family. Job growth in Illinois has been the poorest in the nation since the recession of January 2008. Comparing the number of jobs then to October 2014 shows the state lost over 256,000 jobs. In fact, in 2014, Texas added more jobs in a month than Illinois had for the year as of October. In terms of non-farm payroll jobs, the state recorded 5,924,000 in July 2015, about the same level of jobs in March 2006, and a 2% increase from the low mark in December 2009. The current unemployment rate is 5.8%, almost a full point improvement from the 6.7% rate in July 2014, but still higher than the national rate of 5.3%.

Anemic job growth has been most apparent in Illinois’s manufacturing sector. As of July 2015, the state had 573,600 manufacturing jobs, 5,000 less than the same month in 2014, and a loss of over 100,000 in the past 10 years. Manufacturers, such as Caterpillar Inc., have been moving facilities out of the state for better opportunities for years, often citing the state’s business policies and fiscal problems. The job loss in manufacturing is compounded by the low wages in the sector. The average Illinois manufacturing worker makes $35,400 per year, the lowest in the Midwest, as opposed to a Midwest average of more than $38,100.

A recent Chicago Tribune article termed this the “Summer of the Pink Slip in Illinois,” due to mounting layoffs across the state, “which already lags behind its Midwestern neighbors when it comes to job growth.” William Testa, vice president and director of regional research for the Federal Reserve Bank of Chicago, noted that “in terms of long-term trends, jobs are growing in Illinois, but at a slower rate than in other Midwestern states. Michigan and Indiana, both strong auto industry states, have been propping up the region, while declines in machinery and agriculture have hampered Illinois.”

Welfare Dependency

Nearly 48 million individuals in the United States receive aid from the federal Supplemental Nutrition Assistance Program, commonly referred to as food stamps, up from just 17 million in 2000. For every 1 new person who got a job, 2 were added to the food stamp rolls For every 1 new job created, 3 people were added to the food stamp rolls. The number of people getting food stamps spiked 18% since 2010, even though the number of people in poverty dropped 2% in that time. United States taxpayers spent nearly $80 billion on food stamps last year, up from just $17 billion in 2000. Food stamp spending is growing 10 times faster than federal revenues and 4 times faster than other parts of federal budget.

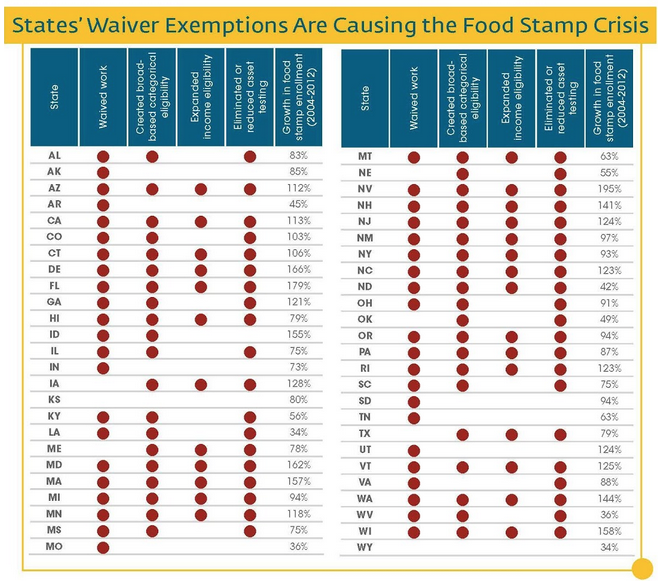

According to the Foundation for Government Accountability (FGA), four elements have contributed to this exponential increase in welfare dependency:

- waived time limits and work requirements for able-bodied adults,

- higher income thresholds,

- broad-based categorical eligibility, and

- eliminated or reduced asset tests

The following table illustrates the expansion elements in each state and how they have contributed to the growth in food stamp enrollment from 2000 to 2012. Illinois experienced a 75% increase in food stamp enrollment during this period.

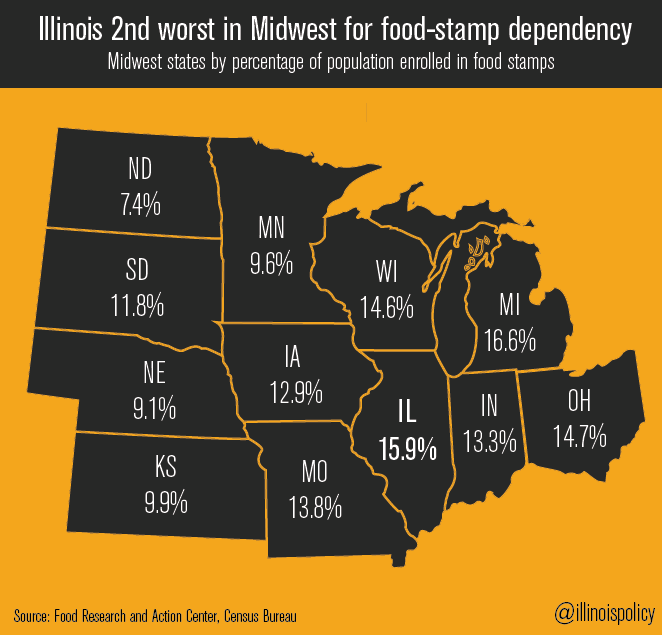

At the end of 2014, a total of 1,052,548 Illinois households were on food stamps. The number represents a staggering of 22% of all Illinois households, an historic level. In fact, since the recent recession ended in 2010, the growth of food stamp enrollment in Illinois has outpaced job growth by 3 to 2, the only state in the Midwest where such inverse growth occurred during the recovery from the recession.

Welfare benefits are structured with intent to address the myriad struggles associated with poverty, and even more, to serve as a foundation for upward economic mobility. But a phenomenon known as the “welfare cliff” creates a poverty trap, making pay raises detrimental because they are outweighed by an even greater, simultaneous decline in welfare benefits.

Research from the Illinois Policy Institute details the welfare cliff experienced by single-parent, two-children households and two-parent, two-children households in Cook, Lake and St. Clair counties, and the city of Chicago.

The research model assumed that families have been aided by refundable tax credits, such as the state and federal Earned Income Tax Credit; cash grants through the Temporary Assistance for Needy Families program; and assistance for food, housing, health care and child care.

Under these assumptions, a working single parent in Chicago would be foolish to take a pay raise to $18 an hour from $12 an hour. They’d fall from the top of the welfare cliff and see a drastic net reduction in benefits, leaving them with as much as one-third less in household resources. This loss would only be made up again by finding a job paying $38 an hour. Read the full article on the Illinois Policy Institute website.