"Growing Out of Control: Property Taxes Put Increasing Burden on Illinois Taxpayers" by Erik Randolph, Senior Fellow; Ted Dabrowski, Vice President of Policy; and John Klingner, Policy Analyst, Illinois Policy Institute

Introduction

Property taxes are the single largest tax in Illinois, burdening residents far more than either income or sales taxes.

Illinoisans already know they pay high property taxes. But what is not as well known is that property taxes are outpacing residents’ ability to pay for them.

- Over the past 50 years, whether measured in comparison to household income, economic growth, population or inflation, all classes of property taxes – residential, commercial, industrial, etc. – have placed an increasingly unaffordable burden on Illinoisans.

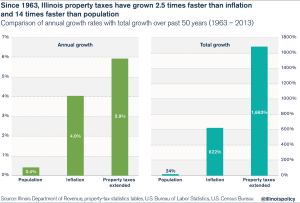

- Since 1963, Illinois property taxes have grown 2.5 times faster than inflation and 14 times faster than the state’s population.

And looking at residential property taxes alone since 1990 shows:

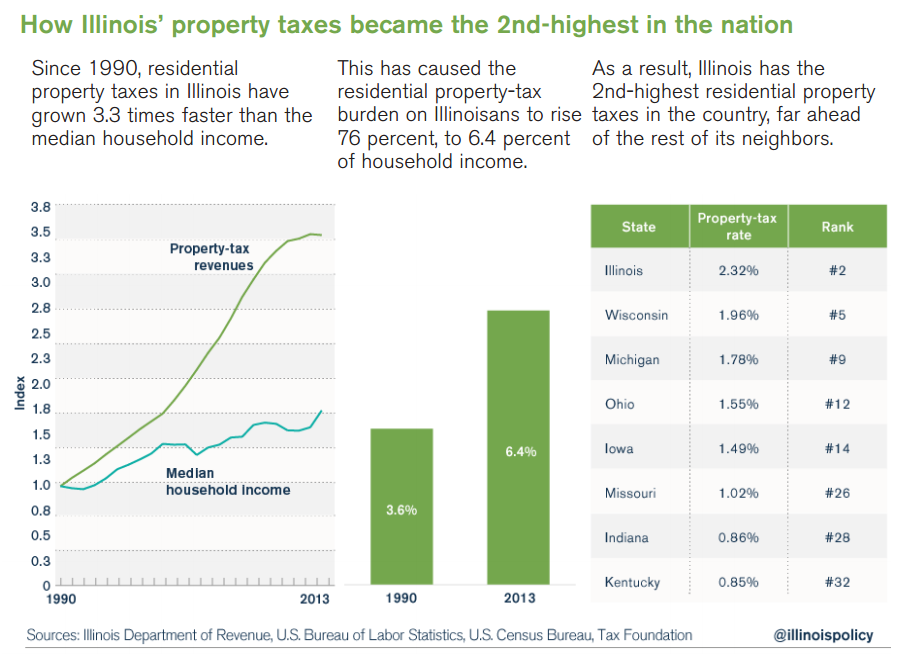

- Residential property taxes in Illinois have grown 3.3 times faster than median household incomes.

- Illinoisans’ residential property-tax burden – as a percentage of median household income – has risen 76 percent.

- If Illinois froze its residential property taxes today, it would take 28 years for residents’ property-tax burden to return to 1990 levels.

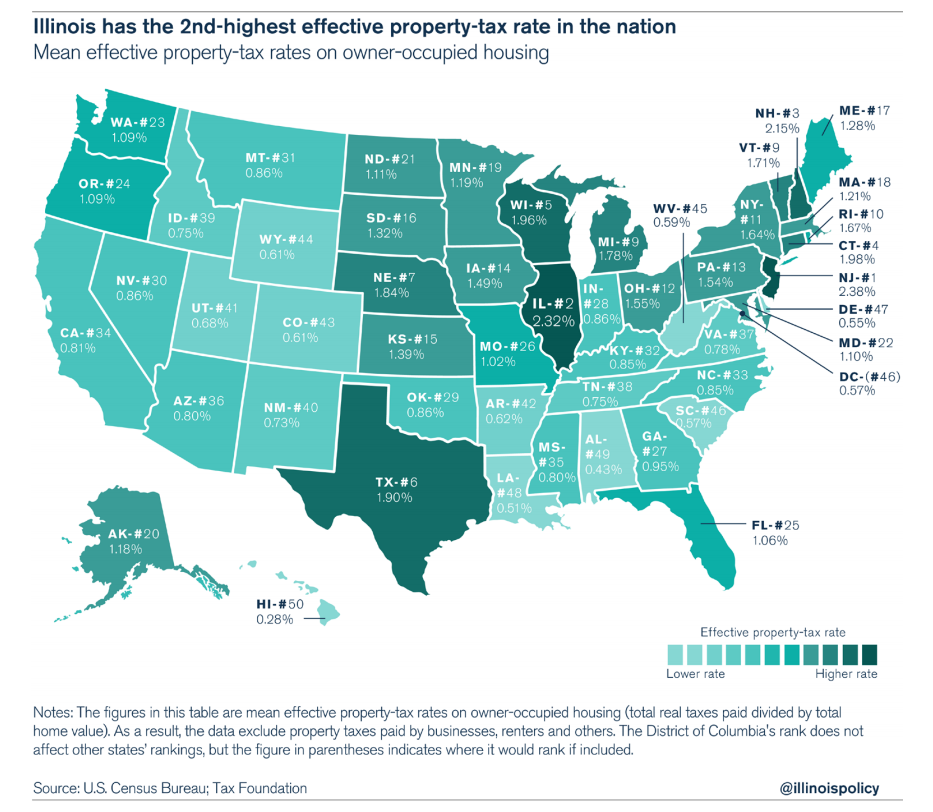

This long history of growth has resulted in an average effective property-tax rate of 2.32 percent in Illinois – the second highest in the nation, behind only New Jersey. And with the Chicago City Council’s passing a record property-tax hike on Oct. 28, Illinois will be in competition for the highest property taxes in the country.

Although all property owners (residential, commercial, industrial, etc.) are paying more in property taxes now than they were 20 years ago, even after adjusting for inflation, the overall tax burden has increasingly fallen more heavily on residential property owners. Twenty years ago, residential taxpayers paid 52 percent of all property taxes. Today, they pay over 64 percent.

Thanks to the complex nature of property taxes in Illinois, it’s also difficult for taxpayers to know just where their tax dollars are going.

Property taxes are the main source of income for local governments in Illinois. The state has nearly 7,000 local government districts with the power to levy property taxes, far more than any other state. These local entities, from airport authorities to forest preserves to fire-protection districts, all levy property taxes that are layered on top of each other – making the total property-tax bill for Illinoisans more expensive and more opaque.

However, the biggest driver of property-tax growth throughout Illinois has been property taxes that fund schools, which constituted 63 percent of all property taxes in 2013.

Since 1970, school-related property taxes have grown at the rate of 5.6 percent a year, 25 percent faster than the 4.1 percent average annual growth in inflation.

All areas in Illinois – whether Cook County, the collar counties or downstate – have experienced growth in property taxes in excess of inflation. Individually, almost every county in Illinois has seen a dramatic increase in its property-tax burden since 2000.

And it’s not that property taxes are high in order to keep other forms of taxation low. Overall, Illinois has one of the highest overall tax burdens of any state, meaning that Illinoisans are taxed more heavily across a majority of tax categories than most other Americans. In fact, Illinois has the ninth-highest state and local tax burden per capita and the 13th-highest burden as a percentage of income.

Fixing the Problem

Illinois has attempted in the past to control the growth of property taxes, most notably through a 1991 law, called PTELL, which capped what a local government could raise via property taxes each year.

The yearly growth in the total amount of taxes raised from existing properties was limited to the lower of 5 percent or inflation. However, the cap is applied only at the aggregate level, and individual taxpayers may see their taxes grow in excess of those limitations.

Not all units of government are subject to this law and it has been largely ineffective in reducing the property-tax burden, adding one more layer of complexity to an already overly complex, broken property-tax system. In 2013, there were taxing districts in 39 counties subject to the cap, meaning that 63 counties were not subject to PTELL.

In Illinois, capping the rate of property-tax growth is not enough. The state needs to reduce the property-tax burden for all Illinois residents. Freezing property taxes at current levels would achieve that objective by lowering the tax burden in relation to the economy and household incomes over time.

However, a property-tax freeze would only be a first step. Other reforms, such as reducing the number of taxing districts and creating new transparency and financial-planning requirements would result in greater efficiencies and would also reduce Illinoisans’ overall property-tax burden.

Illinois' High Overall Tax Burden

Illinois’ Property Taxes are Among the Highest in the U.S.

In order to better understand how the rapid growth of property taxes has harmed Illinois taxpayers, it is important to determine how Illinois’ property taxes and total tax burden compare to those in other states.

Illinois has the second highest effective property-tax rate as a percentage of home value, according to the Tax Foundation. The authors of the study concluded: “New Jersey has the highest effective rate at 2.38 [percent] and is followed closely by Illinois (2.32 [percent]).”6

Another report shows that Illinois ranks 44th in business tax competitiveness when it comes to property taxes. In other words, Illinois has the seventh-most burdensome tax structure with regard to property taxes.

The Tax Foundation concluded in its study that, unlike some other states, Illinois does not maintain high property taxes to compensate for other, lower tax rates:

“Some states with high property taxes, like New Hampshire and Texas, rely heavily on property taxes in lieu of other major tax categories; others, like New Jersey and Illinois, impose high property taxes alongside high rates in the other major tax categories.”

Instead, along with its high property taxes, Illinois has the third-highest corporate income tax, the fifth-highest cellphone tax, the 10th-highest local and state sales tax, the sixth-highest local and state debt per person, the ninth-highest excise taxes, and is one of only 18 states to impose a capital stock tax.

Breaking down Illinois’ property taxes: growth in property taxes outstrips taxpayers’ ability to pay

Property taxes are the biggest of all collected taxes in Illinois

Illinois collects more from residents in property taxes than any other revenue source. In 2013, more than $27 billion was collected in property taxes throughout the state. By comparison, the state collected $18.3 billion in individual income taxes during fiscal year 2013, and $5.2 billion in corporate income taxes and personal-property replacement taxes. Sales and use tax revenue for fiscal year 2013 was $13.2 billion.

Illinois collects more from residents in property taxes than any other revenue source. In 2013, more than $27 billion was collected in property taxes throughout the state. By comparison, the state collected $18.3 billion in individual income taxes during fiscal year 2013, and $5.2 billion in corporate income taxes and personal-property replacement taxes. Sales and use tax revenue for fiscal year 2013 was $13.2 billion.

Growth in property taxes exceeds growth in inflation and population

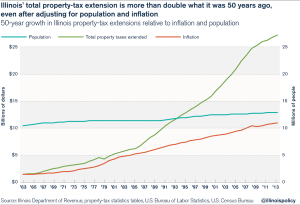

Growth in property-tax extensions, i.e., the total amount of property taxes billed for collection, has outstripped growth in both population and inflation. Over the past 50 years, Illinois’ population has grown at an annual rate of 0.4 percent, inflation has grown at an annual rate of 4.0 percent, and property-tax extensions have grown at a rate of 5.9 percent. In the short run, the difference is not significant, but in the long run, it is extremely important because annual growth rates compound.

Although the average annual growth rate of property-tax extensions is just 1.5 percent over the combined growth rates of both population and inflation – a seemingly small number – it has had a dramatic impact over the last 50 years. Today, the state’s total property-tax extension is more than double what it was 50 years ago, even after adjusting for population growth and inflation.

The burden imposed on taxpayers by property taxes continues to grow

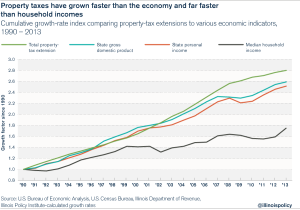

Since 1990, total property-tax extensions have grown 181 percent, exceeding the growth in the economy by approximately 10 percent. The average annual growth for property taxes was 4.6 percent versus 4.2 percent for state gross domestic product, or 4.1 percent for state personal income, which are two similar measurements of economic growth. Meanwhile, Illinois’ median household income has grown by only 76 percent for an average annual rate of only 2.5 percent. Therefore, property-tax payments have grown 60 percent more than median income.

Since 1990, total property-tax extensions have grown 181 percent, exceeding the growth in the economy by approximately 10 percent. The average annual growth for property taxes was 4.6 percent versus 4.2 percent for state gross domestic product, or 4.1 percent for state personal income, which are two similar measurements of economic growth. Meanwhile, Illinois’ median household income has grown by only 76 percent for an average annual rate of only 2.5 percent. Therefore, property-tax payments have grown 60 percent more than median income.

These disparities in the growth rates have two impacts. First, property-tax extensions have been growing faster than the general economy, requiring more economic resources to be dedicated to those governmental services supported by property taxes. Second, using median household income as an indicator of affordability, household incomes have not kept up, requiring many households to set aside greater portions of their income to pay for property taxes.

Taxes are becoming less and less affordable

Over the long run, the high growth rate of property taxes – if allowed to continue – will become unsustainable for taxpayers and the Illinois economy as a whole.

The average household today is less able to afford property taxes than 10 or 20 years ago.

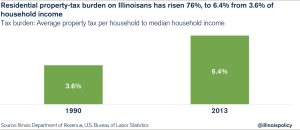

In 1990, the average property-tax payment – calculated by dividing the total number of households, using U.S. Census Bureau data, into the total residential property-tax extension – was $1,183. According to the U.S. Census Bureau, the median household income in 1990 was $32,542. Dividing the average tax payment by the median household income yields 3.6 percent, which provides an indicator of the tax burden for comparison purposes.

In 2000, the average property-tax payment jumped to $2,013, and median household income rose less rapidly to $46,063, pushing the affordability indicator to 4.4 percent. In 2010, the average property tax paid increased by more than 70 percent again, to $3,552, and it increased to $3,654 by 2013. In the meantime, median household income rose only 10 percent to $50,728 between 2000 and 2010, and then increased more significantly to $57,196 in 2013.

In 2000, the average property-tax payment jumped to $2,013, and median household income rose less rapidly to $46,063, pushing the affordability indicator to 4.4 percent. In 2010, the average property tax paid increased by more than 70 percent again, to $3,552, and it increased to $3,654 by 2013. In the meantime, median household income rose only 10 percent to $50,728 between 2000 and 2010, and then increased more significantly to $57,196 in 2013.

In summary, the average residential property-tax payment has grown by a factor of 3.1 from 1990 to 2013. However, median household income has only grown by a factor of 1.8. Using the quotient of the average property-tax payment divided by the median household income as an indicator of the property-tax burden, the tax burden increased to 6.4 percent in 2013 from 3.6 percent in 1990, a 76 percent increase.

Residential Property Taxes Have Increased the Most

In the aggregate, property-tax extensions have grown to $27.1 billion in 2013 from $11.7 billion in 1993. Compared to inflation, property taxes are 50 percent higher today than what they were 20 years ago, for a net gain of $9 billion. Every single class of properties subject to property taxes has contribute to that growth.

In the aggregate, owners of property in all classes are paying more than what they were 20 years ago, even after adjusting for inflation.

But despite revenue growing faster than inflation in all classes of properties, residential property owners in the aggregate are bearing a greater share of the total property-tax burden than ever before. Residential property owners paid slightly more than half of all property-tax extensions in 1993. In 2013, however, they paid nearly two-thirds of the extensions.

Where property taxes have increased the most

The largest share of property taxes supports schools and community colleges. In 2013, school property taxes comprised 63.2 percent of all property-tax extensions, the highest share on record going back to 1968.

Over the past 40 years, from 1973 to 2013, total school property taxes grew at an average annual rate of 5.6 percent, and nonschool property taxes grew at an average annual rate of 5.1 percent. In the meantime, inflation grew only 4.1 percent annually. In 2013, total school property-tax extensions were $17.2 billion, and nonschool property-tax extensions were $10 billion.

Growth in total property-tax extensions during the 1970s did not keep up with inflation partly because of historically high inflation rates. Total school property-tax extensions grew 61.8 percent with an average annual rate of 4.9 percent, and total nonschool property-tax extensions grew 86.3 percent with an average annual rate of 6.4 percent. However, the consumer price index increased 95.1 percent with an average annual rate of 6.9 percent.23

Nonetheless, growth in total tax extensions exceeded inflation during the following decades and more than made up for the shortfall during the 1970s.

Conclusion

Illinois has experienced massive growth in property taxes over the past several decades. This growth has far exceeded the growth of population, inflation and the economy.

Illinois homeowners face an increasingly unaffordable burden from property taxes. When measured against median household income, Illinoisans’ residential property-tax burden is 76 percent higher in 2013 than it was in 1990.

And the state’s increasingly burdensome property taxes are not due to an attempt to keep other taxes low. Instead, property taxes are just one of the many high taxes Illinoisans face. As a result, Illinois has the ninth-highest state and local tax burden per capita, and the 13th-highest burden as a percentage of income.

Due to the burden that property taxes already place on Illinoisans, the state must take steps beyond just moderating the growth in property taxes, as PTELL attempts to accomplish.

Instead, Illinois should reduce the overall burden of property taxes to make them more affordable for average homeowners and to bring Illinois’ effective rates in line with those of other states.

- A universal property-tax freeze would achieve that goal over time.

- Include reducing the number of taxing districts. By consolidating some taxing districts, overhead will be reduced, the number of highly paid executives and staff will be streamlined, and the overall burden borne by taxpayers will become more transparent. Consolidation, therefore, will go a long way toward bringing down property-tax costs.

- The General Assembly should require taxing districts to implement financial plans to deliver services at lower costs. Requiring each district that levies property taxes to submit financial and implementation plans regarding how it will operate more efficiently by providing necessary services at lower costs will help bring greater transparency and accountability to the system.

Questions for Discussion

- What policies can Illinois residents advocate for to reduce their property-tax burden?

- Are you in favor of a property-tax freeze as a first step/temporary solution? What do you think would need to be done in addition to a freeze to fix the problem?

- What are other ways that Illinois’ local governments should/could raise revenue (especially to fund schools, the biggest driver of IL’s property-tax growth)?

- Do you know how many local government bodies you are taxed by? How transparent is your local government regarding budgets and spending?

- How have you/your family experienced and coped with Illinois’ growth in property-tax payments, especially as compared to the comparatively lower growth in median income?

- What’s your opinion on some of the state legislation aimed at reforming Illinois’ property taxes?

- For example, HB4501 (expands the process for government consolidation)

- HB4238 (gives power back to the taxpayer by prohibiting municipalities from increasing or creating any new taxes unless approved by taxpayers through referendum)

- HB5522 (requires local governments to maintain websites with access to documents about budgets, spending ad operations)

Find your glasses to look at this maze to understand how a bill becomes law in IL.

Discussion Guide