Our national debt is a pressing fiscal issue that, unfortunately, doesn’t get as much air time as it should. You may wonder, Why should I care about the national debt? How does it affect me? The truth is that our elected officials must take the debt seriously and understand that we need to be able to pay our bills — especially if we want our future generations to have the prosperity and quality of life that many Baby Boomers and earlier generations have enjoyed.

As Time magazine explained in the article, “Millennials Need the Next President to be Very Worried About the Debt,” the national debt “is at its highest level since 1950 and is on a path to grow rapidly in the coming decades. While there are many dangerous consequences of America’s fiscal outlook, absent a solution, no one will feel more pain than the next generation.”

Read on for a quick run-down of the essential facts, and be sure to also check out The Policy Circle’s brief on Fiscal Responsibility.

The Difference Between the Deficit and the Debt

Deficit: Spending more money than you make.

Debt: Borrowed money, to be repaid later.

As this Marketplace article explains, “The one thing you don’t want to do, as a homeowner, is to use debt to run a deficit. In other words, you don’t want to get into a situation where you’re spending more money than you make, and you’re making up the difference by borrowing…But what about a country? The U.S. has a roughly $17 trillion debt load. And our government spends $306.4 billion more than it earns. And we make up for that $47.2 billion deficit by borrowing even more!”

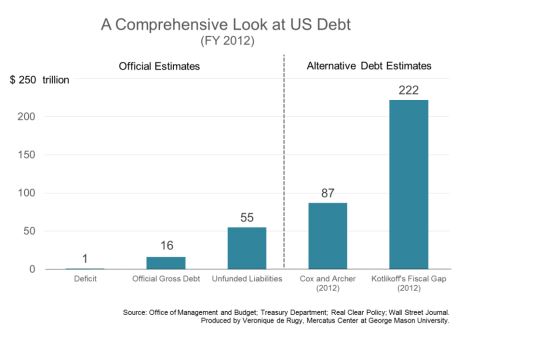

Source: Mercatus Center, George Mason University

If this sounds alarming, that’s because it is.

The White House Office of Budget and Management estimates that by the end of this year, the debt will be $19.4 trillion. As the Washington Examiner points out, “If you divide the $19.4 trillion federal debt by the population, everyone living in the U.S. owes $59,510.”

Worse, the $19.4 trillion figure does not include “unfunded liabilities,” such as Social Security, Medicare and Medicaid. As the Cato Institute explains, “While those liabilities don’t show up on the country’s official balance sheet, they nonetheless represent legal obligations of the US government. Including the expected shortfall from those programs brings our true debt to an unfathomable $90.6 trillion.”

The Debt Crisis, Explained

This PragerU video conceptualizes the debt figure of $17 plus trillion – a number so large that most of us can’t even wrap our heads around it. It also explains how we arrived at this point, how it will impact future generations, and the best solution to tackle our debt crisis.

Dig Deeper

“Washington’s Wake-Up Call: Sky-High Debt and Dismal Growth are Testing Americans’ faith in Democracy,” Mitch Daniels, The Wall Street Journal, September 2016.

“National Debt? What’s That?“, National Review, Michael Tanner, January 2016

“8 Crazy Facts About the National Debt,” The Washington Examiner, August 2016

“National Debt or Federal Deficit? What’s the Difference?“, USGovinfo.com

“You think the Deficit is Bad? Federal Unfunded Liabilities Exceed $127 Trillion,” Forbes