How To Follow The Tax Reform Effort

Taxes are complicated. So, endeavoring to clean up the complicated tax code is complicated. And to top it off, understanding the legislative process for passing major tax reform is also quite complicated. Meanwhile, the House of Representative’s proposal – the Tax Cuts and Jobs Act – is just the beginning of a long process. The final bill will most likely look substantially different.

In order to help you follow the process, we compiled this overview – Tax Reform: Understanding the Debate. It details the legislative process, tax basics, and the major provisions under debate. It may raise many questions as it explores answers – but the summary will provide you with insight into the complex negotiating process our country’s leaders will be engaged in for the remainder of the year.

Important context when reading and talking about tax reform:

- Compromise. An identical bill has to pass the House of Representatives and the Senate before it can be sent to the President for it to be signed into law. Republicans can only lose 2 votes in the Senate and 22 votes in the House and still pass the bill on a party-line vote. This means 50 individual Senators and 218 individual Representatives have to agree that this bill is good for their district, state and for America. Given the depth and breadth of the tax code, most every Senator and Representative faces different tax-related interests in their districts and states. Similar to how the health reform effort played out, the Senate landscape will drive the outcome.

- Tax Basics. The majority of ‘income’ the federal government relies upon to pay its bills comes from the taxes you pay on your income, as well as the payroll taxes that are taken out of your paycheck and the payroll taxes your employer pays on your behalf (unless you’re self-employed, and then you pay it all). The payroll taxes are designed to fund social insurance programs such as social security and medicare.

- The Math. Tax cuts generate deficits before they can generate growth. Members of the House and Senate who voted for the Budget Resolution back in October agreed to allow the tax bill to collect $1.5 trillion less revenue over the next 10 years. The goal is to generate enough economic growth to at least balance that deficit (and start to build in surpluses) after 10 years. This goal also makes the bill compliant with Senate rules. All proposed changes to the current tax system have to be viewed within that requirement of eventual deficit neutrality.

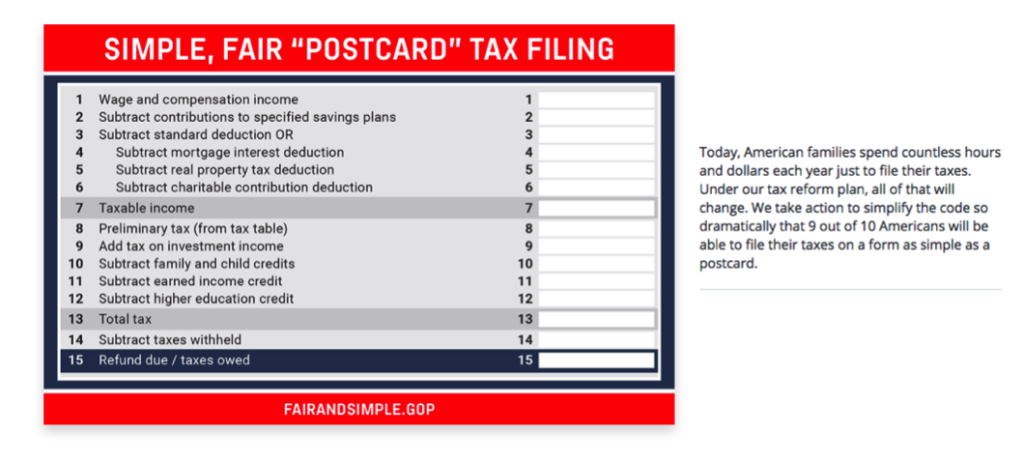

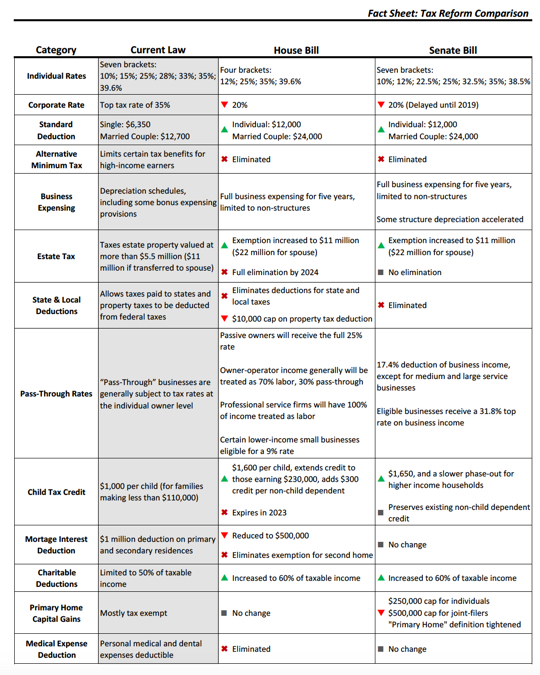

- Simplification and Growth. We dedicated a paragraph to each of the main topics of debate around the Tax Cuts and Jobs Act in this overview. Within the context of “the math” outlined above, the House proposal attempts to 1) dramatically simplify the tax code by reducing tax brackets and eliminating credits and deductions, 2) reduce the tax burden for low- and middle-income Americans, and 3) incentivize economic growth by changing how we tax business operations.

What does this mean for you?

If the effort is successful, you should be able to file your individual or family taxes on a piece of paper the size of a postcard.

If you make over $500,000 as an individual, or over $1 million as a family, you will remain in the top tax bracket.

According to the Ways and Means Committee “a typical middle-income family of four, earning $59,000 (the median household income), will receive a $1,182 tax cut.”

And, according to this bankrate analysis, if you’re “married, you both work and you have a household income of $120,000… You have two kids, contribute a combined $6,000 per year to tax-preferred retirement accounts (such as 401(k)s and IRAs), and you put $5,000 pretax into a dependent care FSA to pay for day care and after-school services. Assuming you take the standard deduction, you’d owe almost $9,200 in 2018 under current law. But that tax bill would drop by about $1,500 under the Republican plan. However, if you were planning to itemize next year, your potential for savings under the tax overhaul could be much different, especially if you live in an area with high state and local taxes.”

These analyses underscore how difficult it is to individualize what the tax reform will mean to you. In general, your available deductions will decrease but your standard deduction will almost double. Families making under $294,000 will also benefit from an increased child tax credit. If you own a business, you will likely see a similar approach of reduced business tax rates while losing some of the credits and deductions that have historically impacted your business planning. See the overview to learn more!

Leave a comment on what detail of the tax plan you’d like to know more about and we’ll write up a summary of that issue!

It’s a movement!

Recommend a Circle Leader. Especially in Nebraska, Wisconsin, Minnesota and Missouri where circles are sprouting.

Start a Circle in your neighborhood. Add value in your community by giving women the facts and the space to strengthen their understanding of the issues.

Invest in The Policy Circle. Together let’s build a network of women who want to assume their civic duties and understand the impact of policy in their lives.

The Policy Circle is a 501(c)3 that provides a fact-based, nonpartisan framework that inspires women living in the same community to connect, learn about and discuss public policies that impact their lives. Women across the nation are taking a leadership role in public policy dialogue on what human creativity can accomplish in a free market economy.